Intermediate Microeconomics and Its Application 12th Edition by Walter Nicholson,Christopher Snyder

Edition 12ISBN: 978-1133189022

Intermediate Microeconomics and Its Application 12th Edition by Walter Nicholson,Christopher Snyder

Edition 12ISBN: 978-1133189022 Exercise 21

Puts, Calls, and Black-Scholes

Options on financial assets are widely traded in organized markets. Not only are there options available on most company's stocks, but there are also a bewildering variety of options on such assets as bonds, foreign exchange, and commodities, or even on indexes based on groups of these assets. Probably the most common options are those related to the stock of a single company. The potential transactions underlying these options are simply promises to buy or sell the stock at a specific ("strike") price over some period in the future. Options to buy a stock at a certain strike price are termed "call" options because the buyer has the right to "call" the stock from someone else if he or she wishes to exercise the option. Options to sell a stock at a certain price are called "put" options (perhaps because you have the option to put the stock into someone else's hands).

Suppose that Microsoft stock is currently selling at $30 per share. A call option might give you the right (but, again, not the obligation) to buy Microsoft in one month at, say, $32 per share.1 Suppose you also believe there is a 50-50 chance that Microsoft will sell for either $35 or $25 in one month's time. Clearly the option to buy at $32 is valuable-the stock might end up at $35. But how much is this option worth?

An Equivalent Portfolio

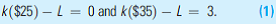

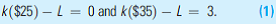

One way that financial economists evaluate options is by asking whether there is another set of assets that would yield the same outcomes as would the option. If such a set exists, one can then argue that it should have the same price as the option because markets will ensure that the same good always has the same price. So, let's consider the outcomes of the Microsoft option. If Microsoft sells for $25 in a month's time, the option is worthless-why pay $32 when the stock can readily be bought for $25? If Microsoft sells for $35, however, the option will be worth $3. Could we duplicate these two payouts with some other set of assets? Suppose we borrow some funds (L) from a bank (with no interest, to make things simple) and buy a fraction (k) of a Microsoft share. After a month, we will sell the fractional share of Microsoft and pay off the loan. In this example, L and k must be chosen to yield the same outcomes as the option. That is,

These two equations can easily be solved as k = 0.3, L = 7.5. That is, buying 0.3 of a Microsoft share and taking a loan of $7.50 will yield the same outcomes as buying the option. The net cost of this strategy is $1.50?$9 to buy 0.3 of a Microsoft share at $30 less the loan of $7.50 (which in our simple case carries no interest). Hence, this also is the value of the option.

The Black-Scholes Theorem

Of course, valuing options in the real world is much more complicated than this simple example suggests. Three specific complications that need to be addressed in developing a more general theory of valuation are as follows: (1) there are far more possibilities for Microsoft stock's price in one month than just the two we assumed; (2) most popular options can be exercised at any time during a specified period, not just on a specific date; and (3) interest rates matter for any economic transaction that occurs over time. Taking account of these factors proved to be very difficult, and it was not until 1973 that Fischer Black and Myron Scholes developed an acceptable valuation model.2 Since that time, the Black-Scholes model has been widely applied to options and other markets. In one of its more innovative applications, the model is now used in reverse to calculate an "implied volatility" expected for stocks in the future. The Chicago Board Options Exchange Volatility Index (VIX) is widely followed in the financial press, where it is taken as a good measure of the current uncertainties involved in stock market investing.

For every buyer of, say, a call option, there must of course also be a seller. Why would someone sell a call option on some shares he or she already owned? How would this be different than buying a put option on this stock?

Options on financial assets are widely traded in organized markets. Not only are there options available on most company's stocks, but there are also a bewildering variety of options on such assets as bonds, foreign exchange, and commodities, or even on indexes based on groups of these assets. Probably the most common options are those related to the stock of a single company. The potential transactions underlying these options are simply promises to buy or sell the stock at a specific ("strike") price over some period in the future. Options to buy a stock at a certain strike price are termed "call" options because the buyer has the right to "call" the stock from someone else if he or she wishes to exercise the option. Options to sell a stock at a certain price are called "put" options (perhaps because you have the option to put the stock into someone else's hands).

Suppose that Microsoft stock is currently selling at $30 per share. A call option might give you the right (but, again, not the obligation) to buy Microsoft in one month at, say, $32 per share.1 Suppose you also believe there is a 50-50 chance that Microsoft will sell for either $35 or $25 in one month's time. Clearly the option to buy at $32 is valuable-the stock might end up at $35. But how much is this option worth?

An Equivalent Portfolio

One way that financial economists evaluate options is by asking whether there is another set of assets that would yield the same outcomes as would the option. If such a set exists, one can then argue that it should have the same price as the option because markets will ensure that the same good always has the same price. So, let's consider the outcomes of the Microsoft option. If Microsoft sells for $25 in a month's time, the option is worthless-why pay $32 when the stock can readily be bought for $25? If Microsoft sells for $35, however, the option will be worth $3. Could we duplicate these two payouts with some other set of assets? Suppose we borrow some funds (L) from a bank (with no interest, to make things simple) and buy a fraction (k) of a Microsoft share. After a month, we will sell the fractional share of Microsoft and pay off the loan. In this example, L and k must be chosen to yield the same outcomes as the option. That is,

These two equations can easily be solved as k = 0.3, L = 7.5. That is, buying 0.3 of a Microsoft share and taking a loan of $7.50 will yield the same outcomes as buying the option. The net cost of this strategy is $1.50?$9 to buy 0.3 of a Microsoft share at $30 less the loan of $7.50 (which in our simple case carries no interest). Hence, this also is the value of the option.

The Black-Scholes Theorem

Of course, valuing options in the real world is much more complicated than this simple example suggests. Three specific complications that need to be addressed in developing a more general theory of valuation are as follows: (1) there are far more possibilities for Microsoft stock's price in one month than just the two we assumed; (2) most popular options can be exercised at any time during a specified period, not just on a specific date; and (3) interest rates matter for any economic transaction that occurs over time. Taking account of these factors proved to be very difficult, and it was not until 1973 that Fischer Black and Myron Scholes developed an acceptable valuation model.2 Since that time, the Black-Scholes model has been widely applied to options and other markets. In one of its more innovative applications, the model is now used in reverse to calculate an "implied volatility" expected for stocks in the future. The Chicago Board Options Exchange Volatility Index (VIX) is widely followed in the financial press, where it is taken as a good measure of the current uncertainties involved in stock market investing.

For every buyer of, say, a call option, there must of course also be a seller. Why would someone sell a call option on some shares he or she already owned? How would this be different than buying a put option on this stock?

Explanation

The financial market has diversified in ...

Intermediate Microeconomics and Its Application 12th Edition by Walter Nicholson,Christopher Snyder

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255