Intermediate Microeconomics and Its Application 12th Edition by Walter Nicholson,Christopher Snyder

Edition 12ISBN: 978-1133189022

Intermediate Microeconomics and Its Application 12th Edition by Walter Nicholson,Christopher Snyder

Edition 12ISBN: 978-1133189022 Exercise 15

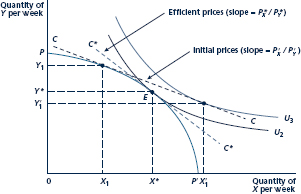

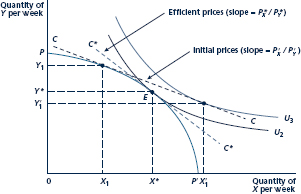

In Chapter 9 we showed that the imposition of a tax involves an ''excess burden.'' How would you show a similar result with a general equilibrium diagram such as Figure? (Note: With the general equilibrium diagram, you must be more specific about how tax revenue is used.)

With an arbitrary initial price ratio, firms will produce X1, Y1; the economy's budget constraint will be given by line CC. With this budget constraint, individuals demand X01 , Y1, that is, there is an excess demand for good X (X01_ X1) and an excess supply of good Y (Y1 _ Y01 ). The workings of the market will move these prices toward their equilibrium levels P_X ,P_Y. At those prices, society's budget constraint will be given by the line C*C*, and supply and demand will be in equilibrium. The combination X*, Y* of goods will be chosen, and this allocation is efficient.

With an arbitrary initial price ratio, firms will produce X1, Y1; the economy's budget constraint will be given by line CC. With this budget constraint, individuals demand X01 , Y1, that is, there is an excess demand for good X (X01_ X1) and an excess supply of good Y (Y1 _ Y01 ). The workings of the market will move these prices toward their equilibrium levels P_X ,P_Y. At those prices, society's budget constraint will be given by the line C*C*, and supply and demand will be in equilibrium. The combination X*, Y* of goods will be chosen, and this allocation is efficient.

Explanation

Single market has been discussed in perf...

Intermediate Microeconomics and Its Application 12th Edition by Walter Nicholson,Christopher Snyder

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255