Intermediate Microeconomics and Its Application 12th Edition by Walter Nicholson,Christopher Snyder

Edition 12ISBN: 978-1133189022

Intermediate Microeconomics and Its Application 12th Edition by Walter Nicholson,Christopher Snyder

Edition 12ISBN: 978-1133189022 Exercise 17

Adverse Selection in Insurance

The earliest application of the idea of adverse selection, and indeed the genesis of the term itself, was in the study of insurance markets. As we saw in Chapter 5, actuarially fair insurance can increase the utility of risk-averse individuals, implying that individuals who face very different probabilities of loss should pay different insurance premiums. The difficulty faced by insurers in this situation is in estimating an individual's probability of loss so that insurance can be correctly priced. When insurers possess less information than do insurance buyers, adverse selection may undermine the entire insurance market.

A Theoretical Model

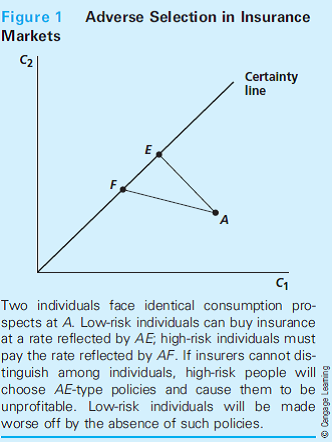

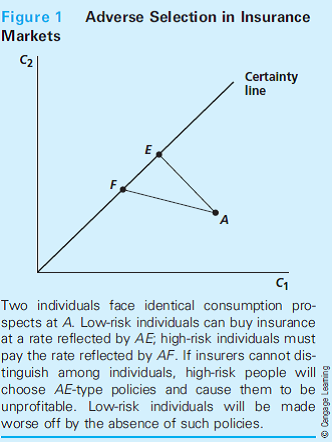

This possibility is illustrated in Figure 1, which assumes that two individuals initially face identical consumption prospects represented by point A. If person 1 has a relatively low risk of incurring state 2, costs of insurance will be low and this individual's budget constraint is given by AE. If insurance is fairly priced, this risk-averse individual would choose to fully insure by moving to point E on the certainty line. For person 2, losses are more likely. Fair insurance costs are represented by AF. This person, too, might choose to be fully insured by moving to point F. If the insurance company cannot tell how risky a particular customer is, however, this twin solution is unstable. Person 2 will recognize that he or she can gain utility by purchasing a policy intended for person 1. The additional losses this implies means that the insurer will lose money on policy AE and will have to increase its price, thereby reducing person 1's utility. Whether there is a final solution to this type of adverse selection is a complex question. It is possible that person 1 may choose to face the world uninsured rather than buy an unfairly priced policy.1

Safe-Driver Policies

Adverse selection arises in all sorts of insurance, ranging from life insurance to health insurance to flood insurance to automobile insurance. Consider the case of automobile insurance. Traditionally, insurers have used accident data to devise group rating factors that assign higher premium costs to groups such as young males and urban dwellers, who tend to be more likely to have accidents. Such rate-setting procedures sometimes come under political attack as unfairly lumping both safe and unsafe drivers together. A 1989 ballot initiative in California, for example, sharply limited the use of rating factors by requiring them to be primarily

individual-based rather than group-based. Because data on individuals are hard to obtain and are not very good at predicting accidents, the main result has been to force rates together for all groups. The main beneficiary of the law seems to have been young male drivers in Los Angeles. Figure 1 suggests that individuals in safer groups (females and rural California residents) may have been the losers.

The U.S. Affordable Care Act (commonly called "Obamacare") contains a number of provisions that can be viewed as addressing adverse-selection problem. Explain the adverseselection problem in the specific context of health insurance. Research the Affordable Care Act and identify the provisions that target the adverse-selection problem. Explain how those provisions would help.

The earliest application of the idea of adverse selection, and indeed the genesis of the term itself, was in the study of insurance markets. As we saw in Chapter 5, actuarially fair insurance can increase the utility of risk-averse individuals, implying that individuals who face very different probabilities of loss should pay different insurance premiums. The difficulty faced by insurers in this situation is in estimating an individual's probability of loss so that insurance can be correctly priced. When insurers possess less information than do insurance buyers, adverse selection may undermine the entire insurance market.

A Theoretical Model

This possibility is illustrated in Figure 1, which assumes that two individuals initially face identical consumption prospects represented by point A. If person 1 has a relatively low risk of incurring state 2, costs of insurance will be low and this individual's budget constraint is given by AE. If insurance is fairly priced, this risk-averse individual would choose to fully insure by moving to point E on the certainty line. For person 2, losses are more likely. Fair insurance costs are represented by AF. This person, too, might choose to be fully insured by moving to point F. If the insurance company cannot tell how risky a particular customer is, however, this twin solution is unstable. Person 2 will recognize that he or she can gain utility by purchasing a policy intended for person 1. The additional losses this implies means that the insurer will lose money on policy AE and will have to increase its price, thereby reducing person 1's utility. Whether there is a final solution to this type of adverse selection is a complex question. It is possible that person 1 may choose to face the world uninsured rather than buy an unfairly priced policy.1

Safe-Driver Policies

Adverse selection arises in all sorts of insurance, ranging from life insurance to health insurance to flood insurance to automobile insurance. Consider the case of automobile insurance. Traditionally, insurers have used accident data to devise group rating factors that assign higher premium costs to groups such as young males and urban dwellers, who tend to be more likely to have accidents. Such rate-setting procedures sometimes come under political attack as unfairly lumping both safe and unsafe drivers together. A 1989 ballot initiative in California, for example, sharply limited the use of rating factors by requiring them to be primarily

individual-based rather than group-based. Because data on individuals are hard to obtain and are not very good at predicting accidents, the main result has been to force rates together for all groups. The main beneficiary of the law seems to have been young male drivers in Los Angeles. Figure 1 suggests that individuals in safer groups (females and rural California residents) may have been the losers.

The U.S. Affordable Care Act (commonly called "Obamacare") contains a number of provisions that can be viewed as addressing adverse-selection problem. Explain the adverseselection problem in the specific context of health insurance. Research the Affordable Care Act and identify the provisions that target the adverse-selection problem. Explain how those provisions would help.

Explanation

Adverse selection refers to occurrence o...

Intermediate Microeconomics and Its Application 12th Edition by Walter Nicholson,Christopher Snyder

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255