Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

Edition 7ISBN: 978-0073376301

Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

Edition 7ISBN: 978-0073376301 Exercise 54

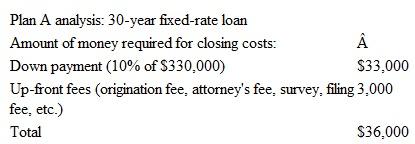

The 30-year fixed-rate mortgage (plan A) is analyzed below. No taxes are considered on proceeds from the savings or investments.

Perform a similar analysis for the 15-year loan (plan B) and the rent-don't buy plan. The Carroltons decided to use the largest future worth after 10 years to select the best of the plans. Do the analysis for them and select the best plan. The amount of the loan is $297,000, and equivalent monthly principal and interest (P I) is determined at 5.25%/12 = 0.4375% per month for 30(12) = 360 months.

The amount of the loan is $297,000, and equivalent monthly principal and interest (P I) is determined at 5.25%/12 = 0.4375% per month for 30(12) = 360 months.

A = 297,000( A / P ,0.4375%,360) = 297,000(0.005522) = $1640

Add the T I of $500 for a total monthly payment of

Payment A = $2140per month

The future worth of plan A is the sum of three future worth components: remainder of the $40,000 available for the closing costs ( F 1A ); left-over money from that available for monthly payments ( F 2 A ); and increase in the house value when it is sold after 10 years ( F 3 A ). These are calculated here.

F 1A = (40,000 36,000)( F / P ,0.5%,120) = $7278

Money available each month to invest after the mortgage payment, and the future worth after 10 years is

2850 2140 = $710

F 2 A = 710( F / A ,0.5%,120) = $116,354

Net money from the sale in 10 years ( F 3 A ) is the difference between the net selling price ($363,000) and the remaining balance on the loan.

Loan balance

= 297,000( F / P ,0.4375%,120) 1640( F / A ,0.4375%, 120) = 297,000(1.6885) 1640(157.3770) = $243,386

F 3 A = 363,000 243,386 = $119,614

Total future worth of plan A is

F A = F 1 A + F 2 A + F 3A

= 7278 + 116,354 + 119,614 = $243,246

Perform a similar analysis for the 15-year loan (plan B) and the rent-don't buy plan. The Carroltons decided to use the largest future worth after 10 years to select the best of the plans. Do the analysis for them and select the best plan.

The amount of the loan is $297,000, and equivalent monthly principal and interest (P I) is determined at 5.25%/12 = 0.4375% per month for 30(12) = 360 months.

The amount of the loan is $297,000, and equivalent monthly principal and interest (P I) is determined at 5.25%/12 = 0.4375% per month for 30(12) = 360 months.A = 297,000( A / P ,0.4375%,360) = 297,000(0.005522) = $1640

Add the T I of $500 for a total monthly payment of

Payment A = $2140per month

The future worth of plan A is the sum of three future worth components: remainder of the $40,000 available for the closing costs ( F 1A ); left-over money from that available for monthly payments ( F 2 A ); and increase in the house value when it is sold after 10 years ( F 3 A ). These are calculated here.

F 1A = (40,000 36,000)( F / P ,0.5%,120) = $7278

Money available each month to invest after the mortgage payment, and the future worth after 10 years is

2850 2140 = $710

F 2 A = 710( F / A ,0.5%,120) = $116,354

Net money from the sale in 10 years ( F 3 A ) is the difference between the net selling price ($363,000) and the remaining balance on the loan.

Loan balance

= 297,000( F / P ,0.4375%,120) 1640( F / A ,0.4375%, 120) = 297,000(1.6885) 1640(157.3770) = $243,386

F 3 A = 363,000 243,386 = $119,614

Total future worth of plan A is

F A = F 1 A + F 2 A + F 3A

= 7278 + 116,354 + 119,614 = $243,246

Explanation

Present worth where A is annual payment...

Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255