Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

Edition 7ISBN: 978-0073376301

Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

Edition 7ISBN: 978-0073376301 Exercise 83

For country 2, MACRS depreciation for 4 years is $33,333, $44,444, $14,815, and $7407, respectively. Determine the

a) CFAT series and b) PW of depreciation, taxes, and CFAT series.

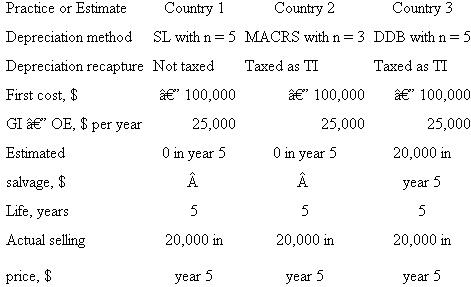

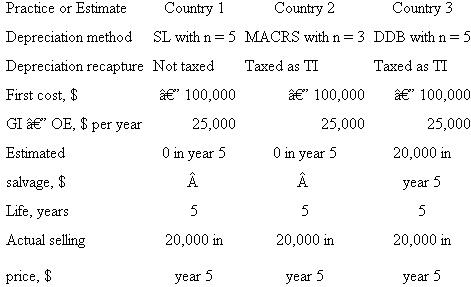

Open Access, Inc. is an international provider of computer network communications gear. Different depreciation, recovery period, and tax law practices in the three countries where depreciable assets are located are summarized in the table. Also, information is provided about assets purchased 5 years ago at each location and sold this year. After-tax MARR = 9% per year and T e = 30% can be used for all countries.

a) CFAT series and b) PW of depreciation, taxes, and CFAT series.

Open Access, Inc. is an international provider of computer network communications gear. Different depreciation, recovery period, and tax law practices in the three countries where depreciable assets are located are summarized in the table. Also, information is provided about assets purchased 5 years ago at each location and sold this year. After-tax MARR = 9% per year and T e = 30% can be used for all countries.

Explanation

Net operating income is gross income min...

Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255