Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

Edition 7ISBN: 978-0073376301

Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

Edition 7ISBN: 978-0073376301 Exercise 66

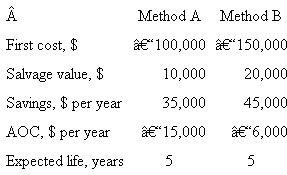

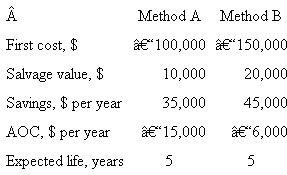

Elias wants to perform an after-tax evaluation of equivalent methods A and B to electrostatically remove airborne particulate matter from clean rooms used to package liquid pharmaceutical products. Using the information shown, MACRS depreciation with n = 3 years, a 5-year study period, after-tax MARR = 7% per year, and T e = 34% and a spreadsheet, he obtained the results AW A = $-2176 and AW B = $3545. Any tax effects when the equipment is salvaged were neglected. Thus, with MACRS depreciation, method B is the better method. Now, use classical SL depreciation with n = 5 years to evaluate the alternatives. Is the decision different from that reached using MACRS

Explanation

Method A:

Year 1-5:

Calculate cash flow...

Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255