Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

Edition 7ISBN: 978-0073376301

Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

Edition 7ISBN: 978-0073376301 Exercise 72

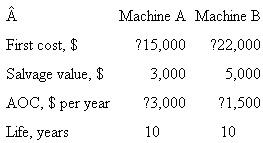

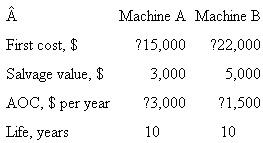

A corporation uses the following: before-tax MARR of 14% per year, after-tax MARR of 7% per year, and T e of 50%. Two new machines have the following estimates.  The machine is retained in use for a total of 10 years, then sold for the estimated salvage value. Select one machine under the following conditions:

The machine is retained in use for a total of 10 years, then sold for the estimated salvage value. Select one machine under the following conditions:

a) Before-tax PW analysis.

b) After-tax PW analysis, using classical SL depreciation over the 10-year life.

c) After-tax PW analysis, using MACRS depreciation with a 5-year recovery period.

The machine is retained in use for a total of 10 years, then sold for the estimated salvage value. Select one machine under the following conditions:

The machine is retained in use for a total of 10 years, then sold for the estimated salvage value. Select one machine under the following conditions:a) Before-tax PW analysis.

b) After-tax PW analysis, using classical SL depreciation over the 10-year life.

c) After-tax PW analysis, using MACRS depreciation with a 5-year recovery period.

Explanation

The formula to calculate the effective t...

Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255