Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

Edition 7ISBN: 978-0073376301

Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

Edition 7ISBN: 978-0073376301 Exercise 80

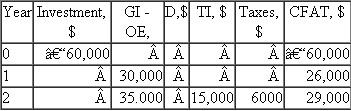

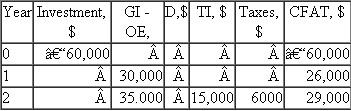

The after-tax analysis for a $60,000 investment with associated gross income minus expenses (GI-OE) is shown below for the first 2 years only. If the effective tax rate is 40%, the values for depreciation d), taxable income (TI), and taxes for year 1 are closest to:  a) D = $5,000, TI = $25,000, taxes = $10,000

a) D = $5,000, TI = $25,000, taxes = $10,000

B) D = $30,000, TI = $30,000, taxes = $4,000

C) D = $20,000, TI = $50,000, taxes = $20,000

D) D = $20,000, TI = $10,000, taxes = $4,000

a) D = $5,000, TI = $25,000, taxes = $10,000

a) D = $5,000, TI = $25,000, taxes = $10,000B) D = $30,000, TI = $30,000, taxes = $4,000

C) D = $20,000, TI = $50,000, taxes = $20,000

D) D = $20,000, TI = $10,000, taxes = $4,000

Explanation

Tax is the mandatory payment that indivi...

Engineering Economy 7th Edition by Leland Blank ,Anthony Tarquin

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255