International Economics 13th Edition by Robert Carbaugh

Edition 13ISBN: 978-1439038949

International Economics 13th Edition by Robert Carbaugh

Edition 13ISBN: 978-1439038949 Exercise 12

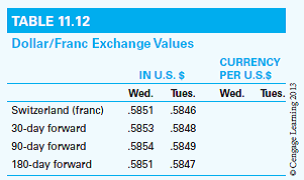

Table 11.12 gives hypothetical dollar/franc exchange values for Wednesday, May 5, 2008.

a. Fill in the last two columns of the table with the reciprocal price of the dollar in terms of the franc.

b. On Wednesday, the spot price of the two currencies was____ dollars per franc, or francs per _____dollar.

c. From Tuesday to Wednesday, in the spot market the dollar (appreciated/depreciated) against the franc; the franc (appreciated/depreciated) against the dollar.

d. In Wednesday's spot market, the cost of buying 100 francs was____ dollars; the cost of buying 100 dollars was_____ francs.

e. On Wednesday, the 30-day forward franc was at a (premium/discount) of_____ dollars, which equaled____ percent on an annual basis. What about the 90-day forward franc?

a. Fill in the last two columns of the table with the reciprocal price of the dollar in terms of the franc.

b. On Wednesday, the spot price of the two currencies was____ dollars per franc, or francs per _____dollar.

c. From Tuesday to Wednesday, in the spot market the dollar (appreciated/depreciated) against the franc; the franc (appreciated/depreciated) against the dollar.

d. In Wednesday's spot market, the cost of buying 100 francs was____ dollars; the cost of buying 100 dollars was_____ francs.

e. On Wednesday, the 30-day forward franc was at a (premium/discount) of_____ dollars, which equaled____ percent on an annual basis. What about the 90-day forward franc?

Explanation

a.

The reciprocal price of the dollar in...

International Economics 13th Edition by Robert Carbaugh

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255