International Financial Management 6th Edition by Sanjiv Eun, Cheol Resnick, Bruce Sabherwal

Edition 6ISBN: 978-0071316972

International Financial Management 6th Edition by Sanjiv Eun, Cheol Resnick, Bruce Sabherwal

Edition 6ISBN: 978-0071316972 Exercise 4

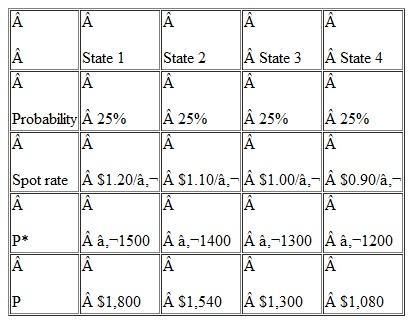

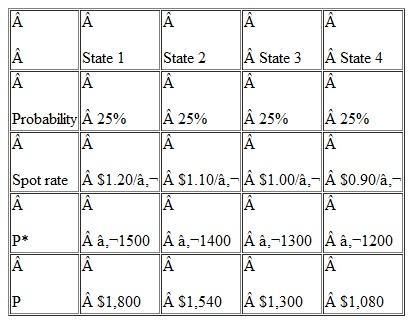

S. firm holds an asset in France and faces the following scenario:  In the above table, P * is the euro price of the asset held by the U.S. firm and P is the dollar price of the asset.

In the above table, P * is the euro price of the asset held by the U.S. firm and P is the dollar price of the asset.

(a) Compute the exchange exposure faced by the U.S. firm.

(b) What is the variance of the dollar price of this asset if the U.S. firm remains unhedged against this exposure

(c) If the U.S. firm hedges against this exposure using the forward contract, what is the variance of the dollar value of the hedged position

In the above table, P * is the euro price of the asset held by the U.S. firm and P is the dollar price of the asset.

In the above table, P * is the euro price of the asset held by the U.S. firm and P is the dollar price of the asset.(a) Compute the exchange exposure faced by the U.S. firm.

(b) What is the variance of the dollar price of this asset if the U.S. firm remains unhedged against this exposure

(c) If the U.S. firm hedges against this exposure using the forward contract, what is the variance of the dollar value of the hedged position

Explanation

Economic Exposure

A company is prone to...

International Financial Management 6th Edition by Sanjiv Eun, Cheol Resnick, Bruce Sabherwal

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255