International Financial Management 6th Edition by Sanjiv Eun, Cheol Resnick, Bruce Sabherwal

Edition 6ISBN: 978-0071316972

International Financial Management 6th Edition by Sanjiv Eun, Cheol Resnick, Bruce Sabherwal

Edition 6ISBN: 978-0071316972 Exercise 1

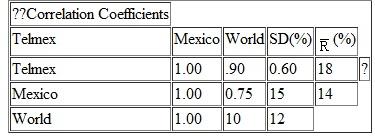

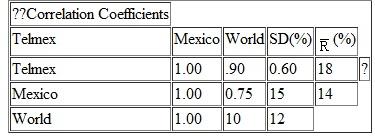

Answer problems 1-3 based on the stock market data given by the following table.  The above table provides the correlations among Telmex, a telephone/communication company located in Mexico, the Mexico stock market index, and the world market index, together with the standard deviations ( SD ) of returns and the expected returns (

The above table provides the correlations among Telmex, a telephone/communication company located in Mexico, the Mexico stock market index, and the world market index, together with the standard deviations ( SD ) of returns and the expected returns (  ). The risk-free rate is 5%.

). The risk-free rate is 5%.

1. Compute the domestic country beta of Telmex as well as its world beta. What do these betas measure

2. Suppose the Mexican stock market is segmented from the rest of the world. Using the CAPM paradigm, estimate the equity cost of capital of Telmex.

3. Suppose now that Telmex has made its shares tradable internationally via cross-listing on NYSE. Again using the CAPM paradigm, estimate Telmex's equity cost of capital. Discuss the possible effects of international pricing of Telmex shares on the share prices and the firm's investment decisions.

The above table provides the correlations among Telmex, a telephone/communication company located in Mexico, the Mexico stock market index, and the world market index, together with the standard deviations ( SD ) of returns and the expected returns (

The above table provides the correlations among Telmex, a telephone/communication company located in Mexico, the Mexico stock market index, and the world market index, together with the standard deviations ( SD ) of returns and the expected returns (  ). The risk-free rate is 5%.

). The risk-free rate is 5%.1. Compute the domestic country beta of Telmex as well as its world beta. What do these betas measure

2. Suppose the Mexican stock market is segmented from the rest of the world. Using the CAPM paradigm, estimate the equity cost of capital of Telmex.

3. Suppose now that Telmex has made its shares tradable internationally via cross-listing on NYSE. Again using the CAPM paradigm, estimate Telmex's equity cost of capital. Discuss the possible effects of international pricing of Telmex shares on the share prices and the firm's investment decisions.

Explanation

Beta:

Beta is a measure of movement/ ch...

International Financial Management 6th Edition by Sanjiv Eun, Cheol Resnick, Bruce Sabherwal

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255