McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522 Exercise 55

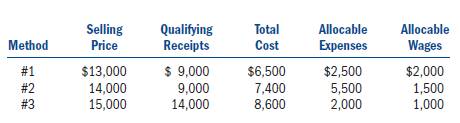

Andrew is considering starting a business of constructing and selling prefabricated greenhouses. There are three very different methods to constructing these greenhouses, and each method results in different revenue and cost projections. Below, Andrew has projected the qualifying revenue and costs for each method. The selling price includes qualifying receipts. The allocable expenses include wages and allocable expenses are included in total costs.

a. Estimate the tax benefit from the domestic production activities deduction for each construction technique. You may assume that Andrew has sufficient AGI to utilize the deduction.

b. Which construction technique should Andrew use if his marginal tax rate is 30 percent

a. Estimate the tax benefit from the domestic production activities deduction for each construction technique. You may assume that Andrew has sufficient AGI to utilize the deduction.

b. Which construction technique should Andrew use if his marginal tax rate is 30 percent

Explanation

Domestic Production Activities Deduction...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255