McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522 Exercise 4

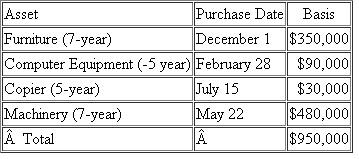

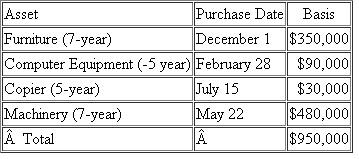

Assume that Timberline Corporation has 2011 taxable income of $240,000 before the §179 expense (assume no bonus depreciation).

a) What is the maximum amount of §179 expense Timberline may deduct for 2011

a) What is the maximum amount of §179 expense Timberline may deduct for 2011

b) What would Timberline's maximum depreciation expense be for 2011

c) What would Timberline's maximum depreciation expense be for 2011 if the furniture cost $2,000,000 instead of $350,000

a) What is the maximum amount of §179 expense Timberline may deduct for 2011

a) What is the maximum amount of §179 expense Timberline may deduct for 2011 b) What would Timberline's maximum depreciation expense be for 2011

c) What would Timberline's maximum depreciation expense be for 2011 if the furniture cost $2,000,000 instead of $350,000

Explanation

Depreciation (MACRS rules)

Depreciation ...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255