McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522 Exercise 47

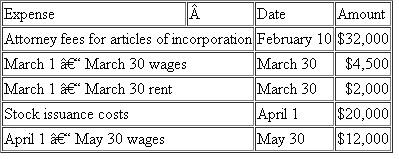

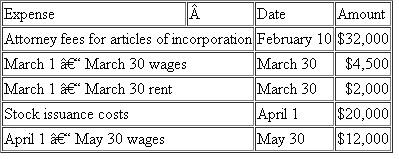

Nicole organized a new corporation. The corporation began business on April 1 of year 1. She made the following expenditures associated with getting the corporation started:

a. What is the total amount of the start-up costs and organizational expenditures for Nicole's corporation

a. What is the total amount of the start-up costs and organizational expenditures for Nicole's corporation

b. What amount of the start-up costs and organizational expenditures may the corporation immediately expense in year 1

c. What amount can the corporation deduct as amortization expense for the organizational expenditures and for the start-up costs for year 1 (not including the amount it immediately expensed)

d. What would be the allowable organizational expenditures, including immediate expensing and amortization, if Ingrid started a sole proprietorship instead

a. What is the total amount of the start-up costs and organizational expenditures for Nicole's corporation

a. What is the total amount of the start-up costs and organizational expenditures for Nicole's corporation b. What amount of the start-up costs and organizational expenditures may the corporation immediately expense in year 1

c. What amount can the corporation deduct as amortization expense for the organizational expenditures and for the start-up costs for year 1 (not including the amount it immediately expensed)

d. What would be the allowable organizational expenditures, including immediate expensing and amortization, if Ingrid started a sole proprietorship instead

Explanation

a.The only qualifying organizational exp...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255