McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522 Exercise 40

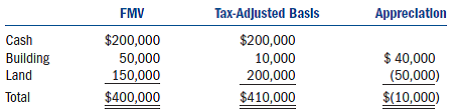

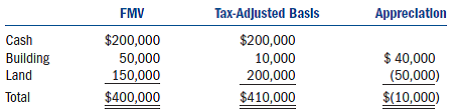

Jefferson Millinery Inc. (JMI) decided to liquidate its wholly owned subsidiary, 8 Miles High Inc. (8MH). 8MH had the following tax accounting balance sheet:

a. What amount of gain or loss does 8MH recognize in the complete liquidation

b. What amount of gain or loss does JMI recognize in the complete liquidation

c. What is JMI's tax basis in the building and land after the complete liquidation

a. What amount of gain or loss does 8MH recognize in the complete liquidation

b. What amount of gain or loss does JMI recognize in the complete liquidation

c. What is JMI's tax basis in the building and land after the complete liquidation

Explanation

Jefferson Millinery, Inc.(JMI)decided to...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255