McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522 Exercise 51

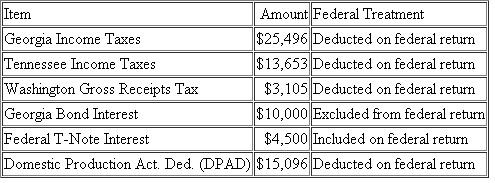

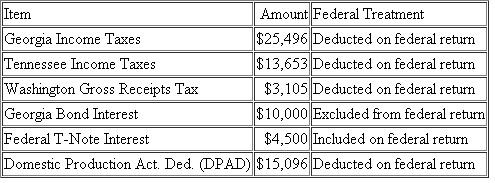

{Research} Bulldog, Incorporated is a Georgia corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

Use the Georgia Corporate Income Tax Form 600 and Instructions to determine what federal/state adjustments need to be made for Georgia. Bulldog's Federal Taxable Income was $194,302. Calculate the Bulldog's Georgia state tax base.

Use the Georgia Corporate Income Tax Form 600 and Instructions to determine what federal/state adjustments need to be made for Georgia. Bulldog's Federal Taxable Income was $194,302. Calculate the Bulldog's Georgia state tax base.

Use the Georgia Corporate Income Tax Form 600 and Instructions to determine what federal/state adjustments need to be made for Georgia. Bulldog's Federal Taxable Income was $194,302. Calculate the Bulldog's Georgia state tax base.

Use the Georgia Corporate Income Tax Form 600 and Instructions to determine what federal/state adjustments need to be made for Georgia. Bulldog's Federal Taxable Income was $194,302. Calculate the Bulldog's Georgia state tax base.Explanation

Taxes

Taxes are the most legitimate and...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255