McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522 Exercise 9

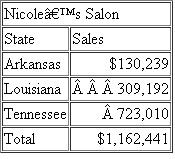

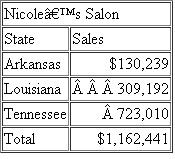

Nicole s Salon, a Louisiana corporation, operates beauty salons in Arkansas, Louisiana, and Tennessee. These salon s sales by state are as follows:

What are the payroll apportionment factors for Arkansas, Louisiana, and Tennessee in each of the following alternative scenarios

What are the payroll apportionment factors for Arkansas, Louisiana, and Tennessee in each of the following alternative scenarios

a) Nicole's Salon has nexus in Arkansas, Louisiana, and Tennessee.

b) Nicole's Salon has nexus in Arkansas, Louisiana, and Tennessee, but $50,000 of the Arkansas amount is paid to independent contractors.

What are the payroll apportionment factors for Arkansas, Louisiana, and Tennessee in each of the following alternative scenarios

What are the payroll apportionment factors for Arkansas, Louisiana, and Tennessee in each of the following alternative scenarios a) Nicole's Salon has nexus in Arkansas, Louisiana, and Tennessee.

b) Nicole's Salon has nexus in Arkansas, Louisiana, and Tennessee, but $50,000 of the Arkansas amount is paid to independent contractors.

Explanation

Taxes

Taxes are the most legitimate and...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255