Basic Econometrics 5th Edition by Damodar Gujarati,Dawn Porter

Edition 5ISBN: 978-0073375779

Basic Econometrics 5th Edition by Damodar Gujarati,Dawn Porter

Edition 5ISBN: 978-0073375779 Exercise 1

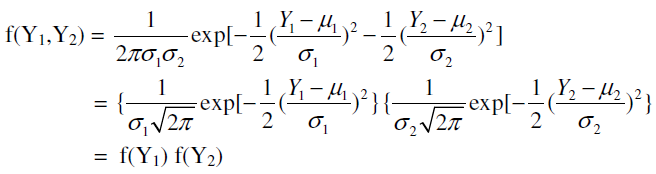

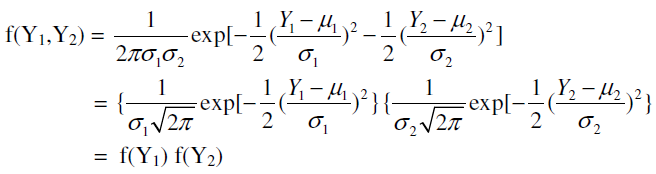

"If two random variables are statistically independent, the coefficient of correlation between the two is zero. But the converse is not necessarily true; that is, zero correlation does not imply statistical independence. However, if two variables are normally distributed, zero correlation necessarily implies statistical independence." Verify this statement for the following joint probability density function of two normally distributed variables Y 1 and Y 2 (this joint probability density function is known as the bivariate normal probability density function):

4 See Appendix A for a general discussion of the properties of the maximum likelihood estimators as well as for the distinction between asymptotic unbiasedness and consistency. Roughly speaking, in asymptotic unbiasedness we try to find out the as n tends to infinity, where n is the sample size on which the estimator is based, whereas in consistency we try to find out how

as n tends to infinity, where n is the sample size on which the estimator is based, whereas in consistency we try to find out how  behaves as n increases indefinitely. Notice that the unbiasedness property is a repeated sampling property of an estimator based on a sample of given size, whereas in consistency we are concerned with the behavior of an estimator as the sample size increases indefinitely.

behaves as n increases indefinitely. Notice that the unbiasedness property is a repeated sampling property of an estimator based on a sample of given size, whereas in consistency we are concerned with the behavior of an estimator as the sample size increases indefinitely.

where µ 1 = mean of Y 1

µ 2 = mean of Y 2

1 = standard deviation of Y 1

2 = standard deviation of Y 2

= coefficient of correlation between Y 1 and Y 2

4 See Appendix A for a general discussion of the properties of the maximum likelihood estimators as well as for the distinction between asymptotic unbiasedness and consistency. Roughly speaking, in asymptotic unbiasedness we try to find out the

as n tends to infinity, where n is the sample size on which the estimator is based, whereas in consistency we try to find out how

as n tends to infinity, where n is the sample size on which the estimator is based, whereas in consistency we try to find out how  behaves as n increases indefinitely. Notice that the unbiasedness property is a repeated sampling property of an estimator based on a sample of given size, whereas in consistency we are concerned with the behavior of an estimator as the sample size increases indefinitely.

behaves as n increases indefinitely. Notice that the unbiasedness property is a repeated sampling property of an estimator based on a sample of given size, whereas in consistency we are concerned with the behavior of an estimator as the sample size increases indefinitely.where µ 1 = mean of Y 1

µ 2 = mean of Y 2

1 = standard deviation of Y 1

2 = standard deviation of Y 2

= coefficient of correlation between Y 1 and Y 2

Explanation

The objective of the following analysis ...

Basic Econometrics 5th Edition by Damodar Gujarati,Dawn Porter

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255