McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068 Exercise 70

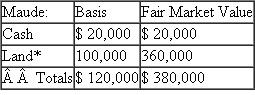

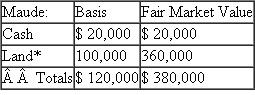

When High Horizon LLC was formed, Maude contributed the following assets in exchange for a 25 percent capital and profits interest in the LLC  ?*Nonrecourse debt secured by the land equals $160,000

?*Nonrecourse debt secured by the land equals $160,000

?James, Harold and Jenny each contributed $220,000 in cash for a 25% profits and capital interest.

?a.How much gain or loss will Maude and the other members recognize?

?b.What is Maude's tax basis in her LLC interest?

?c.What tax basis do James, Harold, and Jenny have in their LLC interests?

?d.What is High Horizon's tax basis in its assets?

?e.Following the format in Exhibit 20-2, prepare a tax basis balance sheet for the High Horizon LLC showing the tax capital accounts for the members.

?*Nonrecourse debt secured by the land equals $160,000

?*Nonrecourse debt secured by the land equals $160,000?James, Harold and Jenny each contributed $220,000 in cash for a 25% profits and capital interest.

?a.How much gain or loss will Maude and the other members recognize?

?b.What is Maude's tax basis in her LLC interest?

?c.What tax basis do James, Harold, and Jenny have in their LLC interests?

?d.What is High Horizon's tax basis in its assets?

?e.Following the format in Exhibit 20-2, prepare a tax basis balance sheet for the High Horizon LLC showing the tax capital accounts for the members.

Explanation

Tax Basis

Tax basis refers to the minim...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255