McGraw-Hill's Taxation of Individuals 3rd Edition by Brian Spilker,Benjamin Ayers,John Robinson,Edmund Outslay ,Ronald Worsham,John Barrick,Connie Weaver

Edition 3ISBN: 978-0077328368

McGraw-Hill's Taxation of Individuals 3rd Edition by Brian Spilker,Benjamin Ayers,John Robinson,Edmund Outslay ,Ronald Worsham,John Barrick,Connie Weaver

Edition 3ISBN: 978-0077328368 Exercise 5

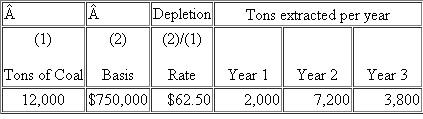

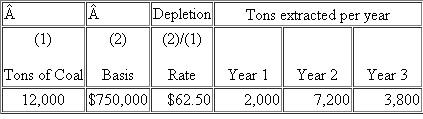

Last Chance Mine (LC) purchased a coal deposit for $750,000.It estimated it would extract 12,000 tons of coal from the deposit.LC mined the coal and sold it reporting gross receipts of $1 million, $3 million, and $2 million for years 1 through 3, respectively.During years 1 - 3, LC reported net income (loss) from the coal deposit activity in the amount of ($20,000), $500,000, and $450,000, respectively.In years 1 - 3, LC actually extracted 13,000 tons of coal as follows:

a.What is Last Chance's cost depletion for years 1, 2, and 3

a.What is Last Chance's cost depletion for years 1, 2, and 3

b.What is Last Chance's percentage depletion for each year (the applicable percentage for coal is 10 percent)

c.Using the cost and percentage depletion computations from the previous parts, what is Last Chance's actual depletion expense for each year

a.What is Last Chance's cost depletion for years 1, 2, and 3

a.What is Last Chance's cost depletion for years 1, 2, and 3b.What is Last Chance's percentage depletion for each year (the applicable percentage for coal is 10 percent)

c.Using the cost and percentage depletion computations from the previous parts, what is Last Chance's actual depletion expense for each year

Explanation

The method used to recover costs of inve...

McGraw-Hill's Taxation of Individuals 3rd Edition by Brian Spilker,Benjamin Ayers,John Robinson,Edmund Outslay ,Ronald Worsham,John Barrick,Connie Weaver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255