Engineering Economy 16th Edition by William Sullivan ,Elin Wicks, Koelling,

Edition 16ISBN: 978-0133439274

Engineering Economy 16th Edition by William Sullivan ,Elin Wicks, Koelling,

Edition 16ISBN: 978-0133439274 Exercise 3

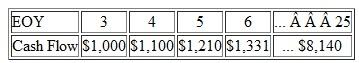

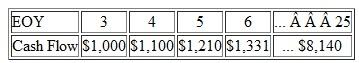

Determine the present worth (at time 0) of the following series of cash flows using a geometric gradient. The real interest rate is 5% per year. (Problem)

Problem

Your rich aunt is going to give you an end-of-year gift of $1,000 for each of the next 10 years.

a. If general price inflation is expected to average 6% per year during the next 10 years, what is the equivalent value of these gifts at the present time The real interest rate is 4% per year.

b. Suppose that your aunt specified that the annual gifts of $1,000 are to be increased by 6% each year to keep pace with inflation. With a real interest rate of 4% per year, what is the current PW of the gifts

Problem

Your rich aunt is going to give you an end-of-year gift of $1,000 for each of the next 10 years.

a. If general price inflation is expected to average 6% per year during the next 10 years, what is the equivalent value of these gifts at the present time The real interest rate is 4% per year.

b. Suppose that your aunt specified that the annual gifts of $1,000 are to be increased by 6% each year to keep pace with inflation. With a real interest rate of 4% per year, what is the current PW of the gifts

Explanation

Present worth where g is geometric grad...

Engineering Economy 16th Edition by William Sullivan ,Elin Wicks, Koelling,

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255