Engineering Economy 16th Edition by William Sullivan ,Elin Wicks, Koelling,

Edition 16ISBN: 978-0133439274

Engineering Economy 16th Edition by William Sullivan ,Elin Wicks, Koelling,

Edition 16ISBN: 978-0133439274 Exercise 6

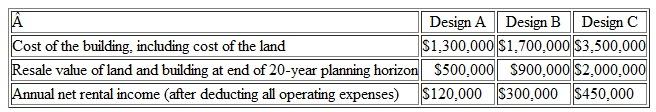

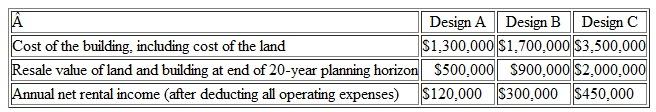

A city is considering buying a piece of land for $500,000 and constructing an office complex on it. Their planning horizon is 20 years. Three mutually exclusive building designs (shown below) have been drawn up by an architectural firm. Use the modified benefit-cost ratio method and a MARR of 10% per year to determine which alternative, if any, should be recommended to the city council. (Problem)

Problem

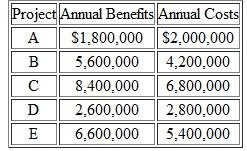

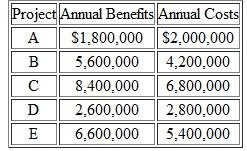

Five independent projects consisting of reinforcing dams, levees, and embankments are available for funding by a certain public agency. The following tabulation shows the equivalent annual benefits and costs for each: (Problem 1)

a. Assume that the projects are of the type for which the benefits can be determined with considerable certainty and that the agency is willing to invest money as long as the B-C ratio is at least one. Which alternatives should be selected for funding

b. What is the rank-ordering of projects from best to worst

c. If the projects involved intangible benefits that required considerable judgment in assigning their values, would your recommendation be affected

Problem 1

Suppose that the toll bridge can be redesigned such that it will have a (virtually) infinite life. MARR remains at 10% per year. Revised costs and revenues (benefits) are given as follows: (Problems)

Capital investment: $22,500,000

Annual operating and maintenance costs: $250,000

Resurface cost every seventh year: $1,000,000

Structural repair cost, every 20th year: $1,750,000

Revenues (treated as constant-no rate of increase): $3,000,000

a. What is the capitalized worth of the bridge

b. Determine the B-C ratio of the bridge over an infinite time horizon.

c. Should the initial design (Problem ) or the new design be selected

Problem

A toll bridge across the Mississippi River is being considered as a replacement for the current 1-40 bridge linking Tennessee to Arkansas. Because this bridge, if approved, will become a part of the U.S. Interstate Highway system, the B-C ratio method must be applied in the evaluation. Investment costs of the structure are estimated to be $17,500,000, and $325,000 per year in operating and maintenance costs arc anticipated. In addition, the bridge must be resurfaced every fifth year of its 30-year projected life at a cost of $1,250,000 per occurrence (no resurfacing cost in year 30). Revenues generated from the toll are anticipated to be $2,500,000 in its first year of operation, with a projected annual rate of increase of 2.25% per year due to the anticipated annual increase in traffic across the bridge. Assuming zero market (salvage) value for the bridge at the end of 30 years and a MARR of 10% per year, should the toll bridge be constructed

Problem

Five independent projects consisting of reinforcing dams, levees, and embankments are available for funding by a certain public agency. The following tabulation shows the equivalent annual benefits and costs for each: (Problem 1)

a. Assume that the projects are of the type for which the benefits can be determined with considerable certainty and that the agency is willing to invest money as long as the B-C ratio is at least one. Which alternatives should be selected for funding

b. What is the rank-ordering of projects from best to worst

c. If the projects involved intangible benefits that required considerable judgment in assigning their values, would your recommendation be affected

Problem 1

Suppose that the toll bridge can be redesigned such that it will have a (virtually) infinite life. MARR remains at 10% per year. Revised costs and revenues (benefits) are given as follows: (Problems)

Capital investment: $22,500,000

Annual operating and maintenance costs: $250,000

Resurface cost every seventh year: $1,000,000

Structural repair cost, every 20th year: $1,750,000

Revenues (treated as constant-no rate of increase): $3,000,000

a. What is the capitalized worth of the bridge

b. Determine the B-C ratio of the bridge over an infinite time horizon.

c. Should the initial design (Problem ) or the new design be selected

Problem

A toll bridge across the Mississippi River is being considered as a replacement for the current 1-40 bridge linking Tennessee to Arkansas. Because this bridge, if approved, will become a part of the U.S. Interstate Highway system, the B-C ratio method must be applied in the evaluation. Investment costs of the structure are estimated to be $17,500,000, and $325,000 per year in operating and maintenance costs arc anticipated. In addition, the bridge must be resurfaced every fifth year of its 30-year projected life at a cost of $1,250,000 per occurrence (no resurfacing cost in year 30). Revenues generated from the toll are anticipated to be $2,500,000 in its first year of operation, with a projected annual rate of increase of 2.25% per year due to the anticipated annual increase in traffic across the bridge. Assuming zero market (salvage) value for the bridge at the end of 30 years and a MARR of 10% per year, should the toll bridge be constructed

Explanation

Modified cost benefit ratio

It is the t...

Engineering Economy 16th Edition by William Sullivan ,Elin Wicks, Koelling,

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255