Engineering Economy 16th Edition by William Sullivan ,Elin Wicks, Koelling,

Edition 16ISBN: 978-0133439274

Engineering Economy 16th Edition by William Sullivan ,Elin Wicks, Koelling,

Edition 16ISBN: 978-0133439274 Exercise 2

The Caterpillar Company has a beta (a measure of common stock volatility) of 1.28. What is its estimated cost of equity capital based on the CAPM when the risk-free interest rate is 2.5% (Problem)

Problem

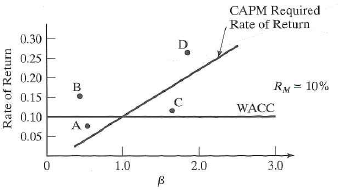

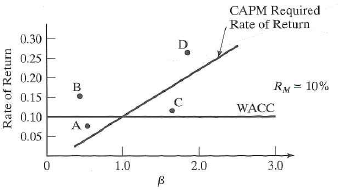

Refer to the associated graph. Identify when the WACC approach to project acceptability agrees with the CAPM approach. When do recommendations of the two approaches differ Explain why.

Problem

Refer to the associated graph. Identify when the WACC approach to project acceptability agrees with the CAPM approach. When do recommendations of the two approaches differ Explain why.

Explanation

According to the question if t...

Engineering Economy 16th Edition by William Sullivan ,Elin Wicks, Koelling,

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255