Engineering Economy 16th Edition by William Sullivan ,Elin Wicks, Koelling,

Edition 16ISBN: 978-0133439274

Engineering Economy 16th Edition by William Sullivan ,Elin Wicks, Koelling,

Edition 16ISBN: 978-0133439274 Exercise 4

A firm is considering a capital investment. The risk premium is 0.04, and it is considered to be constant through time. Riskless investments may now be purchased to yield 0.06 (6%). If the project's beta ( ) is 1.5, what is the expected return for this investment (Problem)

Problem

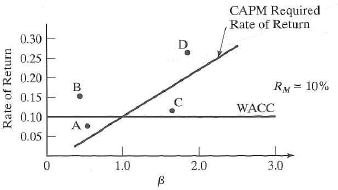

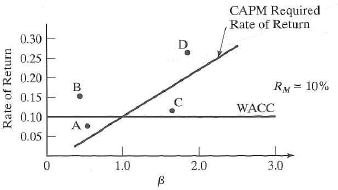

Refer to the associated graph. Identify when the WACC approach to project acceptability agrees with the CAPM approach. When do recommendations of the two approaches differ Explain why.

Problem

Refer to the associated graph. Identify when the WACC approach to project acceptability agrees with the CAPM approach. When do recommendations of the two approaches differ Explain why.

Explanation

Risk premium of any stock is given by th...

Engineering Economy 16th Edition by William Sullivan ,Elin Wicks, Koelling,

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255