Principles of Risk Management and Insurance 13th Edition by George Rejda,Michael McNamara

Edition 13ISBN: 978-0134082578

Principles of Risk Management and Insurance 13th Edition by George Rejda,Michael McNamara

Edition 13ISBN: 978-0134082578 Exercise 1

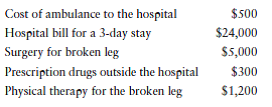

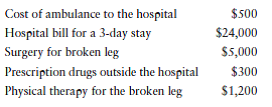

Margo, age 35, was severely injured in an auto accident. She is covered under her employer's preferred provider organization (PPO) plan. The plan has a $1,000 calendar-year deductible, 80/20 percent coinsurance, and an annual out-of-pocket maximum limit of $3,000. As a result of the accident, Margo incurred the following medical expenses:

In addition, Margo could not work for 1 month and lost $4,000 in earnings.

a. Based on this information, how much will Margo collect for her injury if she receives medical care from healthcare providers who are part of the PPO network? (Assume that all charges shown are the allowable or approved charges by the insurer and all providers are in the PPO network.)

b. Assume that Margo's broken leg does not heal properly, and she needs another surgical operation. Margo would like a different surgeon with an outstanding professional reputation to perform the operation. The surgeon is not a member of the PPO network. Will Margo's plan pay for the surgery? Explain your answer.

In addition, Margo could not work for 1 month and lost $4,000 in earnings.

a. Based on this information, how much will Margo collect for her injury if she receives medical care from healthcare providers who are part of the PPO network? (Assume that all charges shown are the allowable or approved charges by the insurer and all providers are in the PPO network.)

b. Assume that Margo's broken leg does not heal properly, and she needs another surgical operation. Margo would like a different surgeon with an outstanding professional reputation to perform the operation. The surgeon is not a member of the PPO network. Will Margo's plan pay for the surgery? Explain your answer.

Explanation

Preferred provider organizations (PPO) p...

Principles of Risk Management and Insurance 13th Edition by George Rejda,Michael McNamara

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255