Business 8th Edition by Marianne Jennings

Edition 8ISBN: 978-1285428710

Business 8th Edition by Marianne Jennings

Edition 8ISBN: 978-1285428710 Exercise 13

Escott v BarChris Constr. Corp. 283 F. Supp. 643 (S.D.N.Y. 1968)

Bowling for Fraud Right Up Our Alley

Facts

BarChris was a bowling alley company established in 1946. The bowling industry grew rapidly when automatic pin resetters went on the market in the mid-1950s. BarChris began a program of rapid expansion and in 1960 was responsible for the construction of over 3 percent of all bowling alleys in the United States. BarChris used two methods of financing the construction of these alleys, both of which substantially drained the company's cash flow.

In 1959 BarChris sold approximately one-half million shares of common stock. By I960, its cash flow picture was still troublesome, and it sold debentures. The debenture issue was registered with the SEC, approved, and sold. In spite of the cash boost from the sale, BarChris was still experiencing financial difficulties and declared bankruptcy in October 1962. The debenture holders were not paid their interest; BarChris defaulted.

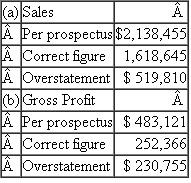

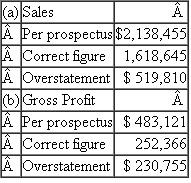

The purchasers of the BarChris debentures brought suit under Section 11 of the 1933 act. They claimed that the registration statement filed by BarChris contained false information and failed to disclose certain material information. Their suit, which centered around the audited financial statements prepared by a CPA firm, claimed that the statements were inaccurate and full of omissions. The following chart summarizes the problems with the financial statements submitted with the registration statements.

Earnings Figures for Quarter Ending March 31 , 1961

Bowling for Fraud Right Up Our Alley

Facts

BarChris was a bowling alley company established in 1946. The bowling industry grew rapidly when automatic pin resetters went on the market in the mid-1950s. BarChris began a program of rapid expansion and in 1960 was responsible for the construction of over 3 percent of all bowling alleys in the United States. BarChris used two methods of financing the construction of these alleys, both of which substantially drained the company's cash flow.

In 1959 BarChris sold approximately one-half million shares of common stock. By I960, its cash flow picture was still troublesome, and it sold debentures. The debenture issue was registered with the SEC, approved, and sold. In spite of the cash boost from the sale, BarChris was still experiencing financial difficulties and declared bankruptcy in October 1962. The debenture holders were not paid their interest; BarChris defaulted.

The purchasers of the BarChris debentures brought suit under Section 11 of the 1933 act. They claimed that the registration statement filed by BarChris contained false information and failed to disclose certain material information. Their suit, which centered around the audited financial statements prepared by a CPA firm, claimed that the statements were inaccurate and full of omissions. The following chart summarizes the problems with the financial statements submitted with the registration statements.

Earnings Figures for Quarter Ending March 31 , 1961

Explanation

Russo was the chief executive officer of...

Business 8th Edition by Marianne Jennings

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255