Economics 1st Edition by Dean Karlan,Jonathan Morduch

Edition 1ISBN: 978-0073511498

Economics 1st Edition by Dean Karlan,Jonathan Morduch

Edition 1ISBN: 978-0073511498 Exercise 6

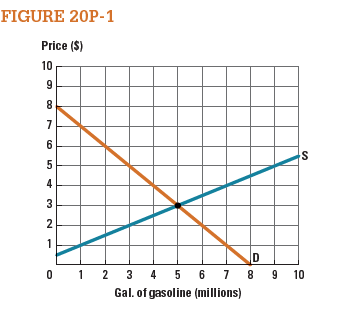

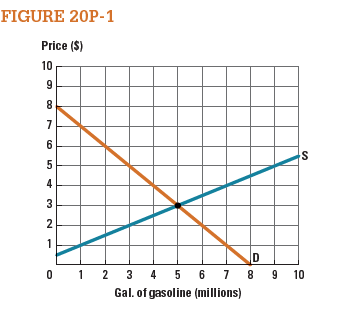

Figure 20P-1 shows a hypothetical market for gasoline.

A) Suppose an excise tax of $1.50 per gallon is levied on gasoline. What price will consumers pay? What price will sellers receive?

B) How much government revenue will result from the tax?

C) Suppose the tax is raised to $3 per gallon. How much additional revenue will this raise compared to the $1.50 tax?

D) Would raising the tax further to $4.50 per gallon increase or decrease tax revenue?

A) Suppose an excise tax of $1.50 per gallon is levied on gasoline. What price will consumers pay? What price will sellers receive?

B) How much government revenue will result from the tax?

C) Suppose the tax is raised to $3 per gallon. How much additional revenue will this raise compared to the $1.50 tax?

D) Would raising the tax further to $4.50 per gallon increase or decrease tax revenue?

Explanation

Figure -1 illustrates the impact of $1.5...

Economics 1st Edition by Dean Karlan,Jonathan Morduch

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255