Economics 20th Edition by Campbell McConnell ,Stanley Brue ,Sean Flynn

Edition 20ISBN: 978-0077660772

Economics 20th Edition by Campbell McConnell ,Stanley Brue ,Sean Flynn

Edition 20ISBN: 978-0077660772 Exercise 2

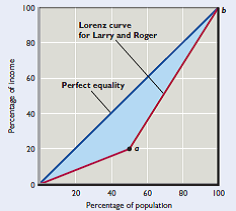

Imagine an economy with only two people. Larry earns $20,000 per year, while Roger earns $80,000 per year. As shown in the folfigure, the curve for this two-person economy consists of two line segments. The first runs from the origin to point a , while the second runs from point a to point b.

a. Calculate the Gini ratio for this two-person economy using the geometric formulas for the area of a triangle (= ½ × base × height) and the area of a rectangle (= base × height). (Hint: The area under the line segment from point a to point b can be thought of as the sum of the area of a particular triangle and the area of a particular rectangle.)b. What would the Gini ratio be if the government taxed $20,000 away from Roger and gave it to Larry? (Hint: The figure will change.)c. Start again with Larry earning $20,000 per year and Roger earning $80,000 per year. What would the Gini ratio be if both their incomes doubled? How much has the Gini ratio changed from before the doubling in incomes to after the doubling in incomes?

a. Calculate the Gini ratio for this two-person economy using the geometric formulas for the area of a triangle (= ½ × base × height) and the area of a rectangle (= base × height). (Hint: The area under the line segment from point a to point b can be thought of as the sum of the area of a particular triangle and the area of a particular rectangle.)b. What would the Gini ratio be if the government taxed $20,000 away from Roger and gave it to Larry? (Hint: The figure will change.)c. Start again with Larry earning $20,000 per year and Roger earning $80,000 per year. What would the Gini ratio be if both their incomes doubled? How much has the Gini ratio changed from before the doubling in incomes to after the doubling in incomes?

Explanation

(a) Remember that the Gini ratio is simp...

Economics 20th Edition by Campbell McConnell ,Stanley Brue ,Sean Flynn

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255