Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 26ISBN: 978-1285743615

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 26ISBN: 978-1285743615 Exercise 54

Recording partner's original investment

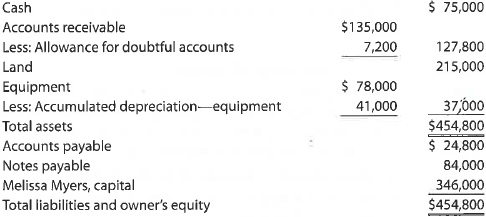

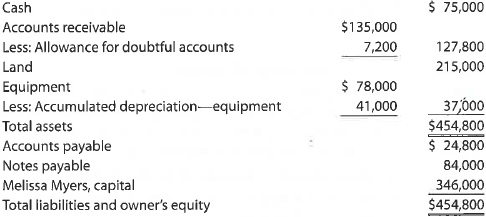

Melissa Myers and Hugo Hernandez form a partnership by combining assets of their former businesses. The following balance sheet information is provided by Myers, sole proprietorship:

Myers obtained appraised values for the land and equipment as follows:

An analysis of the accounts receivable indicated that the allowance for doubtful accounts should be increased to $9,200.

Journalize the partnership's entry for Myers' investment.

Melissa Myers and Hugo Hernandez form a partnership by combining assets of their former businesses. The following balance sheet information is provided by Myers, sole proprietorship:

Myers obtained appraised values for the land and equipment as follows:

An analysis of the accounts receivable indicated that the allowance for doubtful accounts should be increased to $9,200.

Journalize the partnership's entry for Myers' investment.

Explanation

To journalize the partnership's entry fo...

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255