Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 26ISBN: 978-1285743615

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 26ISBN: 978-1285743615 Exercise 14

Profitability and stockholder ratios

Deere Co. manufactures and distributes farm and construction machinery that it sells around the world. In addition to its manufacturing operations, Deere Co.'s credit division loans money to customers to finance the purchase of their farm and construction equipment.

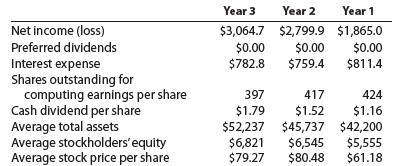

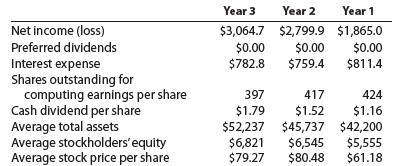

The following information is available for three recent years (in millions except per-share amounts):

1. Calculate the following ratios for each year (Round percentages to one decimal place):

a. Rate earned on total assets

b. Rate earned on stockholders' equity

c. Earnings per share

d. Dividend yield

e. Price-earnings ratio

2. What is the ratio of average liabilities to average stockholders' equity for Year 3

3. Based on these data, evaluate Deere Co.'s performance

Deere Co. manufactures and distributes farm and construction machinery that it sells around the world. In addition to its manufacturing operations, Deere Co.'s credit division loans money to customers to finance the purchase of their farm and construction equipment.

The following information is available for three recent years (in millions except per-share amounts):

1. Calculate the following ratios for each year (Round percentages to one decimal place):

a. Rate earned on total assets

b. Rate earned on stockholders' equity

c. Earnings per share

d. Dividend yield

e. Price-earnings ratio

2. What is the ratio of average liabilities to average stockholders' equity for Year 3

3. Based on these data, evaluate Deere Co.'s performance

Explanation

(In millions except per share amounts)

...

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255