Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 26ISBN: 978-1285743615

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 26ISBN: 978-1285743615 Exercise 32

Sales mix and break-even sales

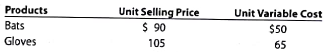

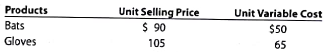

Dragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $620,000, and the sales mix is 40% bats and 60% gloves. The unit selling price and the unit variable cost for each product are as follows:

a. Compute the break-even sales (units) for the overall product, E.

b. How many units of each product, baseball bats and baseball gloves, would be sold at the break-even point

Dragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $620,000, and the sales mix is 40% bats and 60% gloves. The unit selling price and the unit variable cost for each product are as follows:

a. Compute the break-even sales (units) for the overall product, E.

b. How many units of each product, baseball bats and baseball gloves, would be sold at the break-even point

Explanation

a. Sales mix and break-even an...

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255