Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Edition 1ISBN: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Edition 1ISBN: 978-0538736787 Exercise 37

PREDETERMINED OVERHEAD RATE, OVERHEAD VARIANCES, JOURNAL ENTRIES

Menotti Company uses a predetermined overhead rate to assign overhead to jobs. Because Menotti's production is machine intensive, overhead is applied on the basis of machine hours. The expected overhead for the year was $3.8 million, and the practical level of activity is 250,000 machine hours.

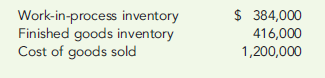

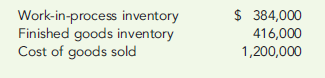

During the year, Menotti used 255,000 machine hours and incurred actual overhead costs of $3.82 million. Menotti also had the following balances of applied overhead in its accounts:

Required:

1. Compute a predetermined overhead rate for Menotti.

2. Compute the overhead variance, and label it as under- or over applied.

3. Assuming the overhead variance is immaterial, prepare the journal entry to dispose of the variance at the end of the year.

4. Assuming the overhead variance is material, prepare the journal entry that appropriately disposes of the overhead variance at the end of the year.

Menotti Company uses a predetermined overhead rate to assign overhead to jobs. Because Menotti's production is machine intensive, overhead is applied on the basis of machine hours. The expected overhead for the year was $3.8 million, and the practical level of activity is 250,000 machine hours.

During the year, Menotti used 255,000 machine hours and incurred actual overhead costs of $3.82 million. Menotti also had the following balances of applied overhead in its accounts:

Required:

1. Compute a predetermined overhead rate for Menotti.

2. Compute the overhead variance, and label it as under- or over applied.

3. Assuming the overhead variance is immaterial, prepare the journal entry to dispose of the variance at the end of the year.

4. Assuming the overhead variance is material, prepare the journal entry that appropriately disposes of the overhead variance at the end of the year.

Explanation

We are given the overhead data of M Comp...

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255