Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Edition 1ISBN: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Edition 1ISBN: 978-0538736787 Exercise 32

PREDETERMINED OVERHEAD RATES, OVERHEAD VARIANCES, UNIT COSTS

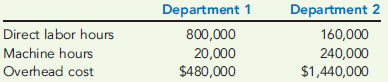

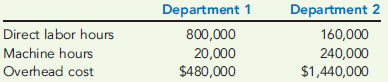

Ultima Company produces two products and uses a predetermined overhead rate to apply overhead. Ultima currently applies overhead using a plantwide rate based on direct labor hours. Consideration is being given to the use of departmental overhead rates where overhead would be applied on the basis of direct labor hours in Department 1 and on the basis of machine hours in Department 2. At the beginning of the year, the following estimates are provided:

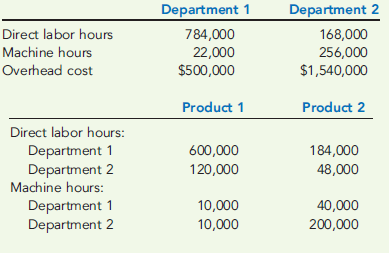

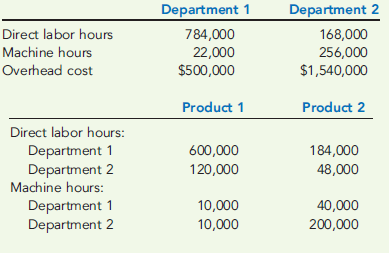

Actual results reported by department and product during the year are as follows:

Required:

1. Compute the plantwide predetermined overhead rate and calculate the overhead assigned to each product.

2. Calculate the predetermined departmental overhead rates and calculate the overhead assigned to each product.

3. Using departmental rates, compute the applied overhead for the year. What is the under- or overapplied overhead for the firm?

4. Prepare the journal entry that disposes of the overhead variance calculated in Requirement 3, assuming it is not material in amount. What additional information would you need if the variance is material to make the appropriate journal entry?

Ultima Company produces two products and uses a predetermined overhead rate to apply overhead. Ultima currently applies overhead using a plantwide rate based on direct labor hours. Consideration is being given to the use of departmental overhead rates where overhead would be applied on the basis of direct labor hours in Department 1 and on the basis of machine hours in Department 2. At the beginning of the year, the following estimates are provided:

Actual results reported by department and product during the year are as follows:

Required:

1. Compute the plantwide predetermined overhead rate and calculate the overhead assigned to each product.

2. Calculate the predetermined departmental overhead rates and calculate the overhead assigned to each product.

3. Using departmental rates, compute the applied overhead for the year. What is the under- or overapplied overhead for the firm?

4. Prepare the journal entry that disposes of the overhead variance calculated in Requirement 3, assuming it is not material in amount. What additional information would you need if the variance is material to make the appropriate journal entry?

Explanation

We are given the estimated and actual da...

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255