Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Edition 1ISBN: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Edition 1ISBN: 978-0538736787 Exercise 45

PREDETERMINED OVERHEAD RATE, APPLICATION OF OVERHEAD TO JOBS, JOB COST, UNIT COST

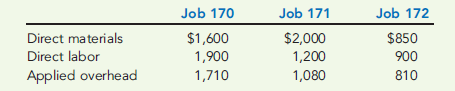

On August 1, Dabo Company's work-in-process inventory consisted of three jobs with the following costs:

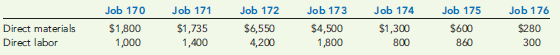

During August, four more jobs were started. Information on costs added to the seven jobs during the month is as follows:

Before the end of August, Jobs 170, 172, 173, and 175 were completed. On August 31, Jobs 172 and 175 were sold.

Required:

1. Calculate the predetermined overhead rate based on direct labor cost.

2. Calculate the ending balance for each job as of August 31.

3. Calculate the ending balance of Work in Process as of August 31.

4. Calculate the cost of goods sold for August.

5. Assuming that Dabo prices its jobs at cost plus 50 percent, calculate Dabo's sales revenue for August.

On August 1, Dabo Company's work-in-process inventory consisted of three jobs with the following costs:

During August, four more jobs were started. Information on costs added to the seven jobs during the month is as follows:

Before the end of August, Jobs 170, 172, 173, and 175 were completed. On August 31, Jobs 172 and 175 were sold.

Required:

1. Calculate the predetermined overhead rate based on direct labor cost.

2. Calculate the ending balance for each job as of August 31.

3. Calculate the ending balance of Work in Process as of August 31.

4. Calculate the cost of goods sold for August.

5. Assuming that Dabo prices its jobs at cost plus 50 percent, calculate Dabo's sales revenue for August.

Explanation

We are given the work in process and cos...

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255