Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Edition 1ISBN: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Edition 1ISBN: 978-0538736787 Exercise 19

ACTIVITY-BASED COSTING, UNIT COST, ENDING WORK-INPROCESS INVENTORY

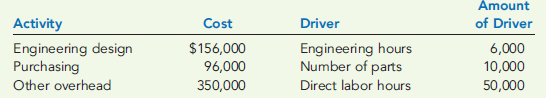

Appleton Company is a job-order costing firm that uses activity-based costing to apply overhead to jobs. Appleton identified three overhead activities and related drivers. Budgeted information for the year is as follows:

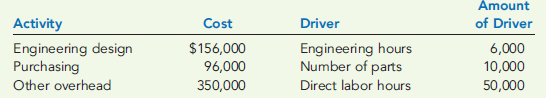

Appleton worked on five jobs in March. Data are as follows:

By March 31, Jobs 15, 16, and 17 were completed and sold. The remaining jobs were in process.

Required:

1. Calculate the activity rates for each of the three overhead activities.

2. Prepare job-order cost sheets for each job showing all costs through March 31. What is the cost of each job by the end of March?

3. Calculate the balance in Work in Process on March 31.

4. Calculate cost of goods sold for March.

Appleton Company is a job-order costing firm that uses activity-based costing to apply overhead to jobs. Appleton identified three overhead activities and related drivers. Budgeted information for the year is as follows:

Appleton worked on five jobs in March. Data are as follows:

By March 31, Jobs 15, 16, and 17 were completed and sold. The remaining jobs were in process.

Required:

1. Calculate the activity rates for each of the three overhead activities.

2. Prepare job-order cost sheets for each job showing all costs through March 31. What is the cost of each job by the end of March?

3. Calculate the balance in Work in Process on March 31.

4. Calculate cost of goods sold for March.

Explanation

We are given the budgeted information of...

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255