Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Edition 1ISBN: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Edition 1ISBN: 978-0538736787 Exercise 3

PHYSICAL UNITS METHOD

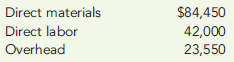

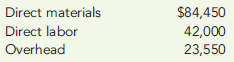

Alomar Company manufactures four products from a joint production process: colgene, delgene, prosone, and freol. The joint costs for one batch are as follows:

At the split-off point, a batch yields 1,200 colgene, 1,800 delgene, 3,000 prosone, and 3,600 freol. All products are sold at the split-off point: colgene sells for $60 per unit, delgene sells for $75 per unit, prosone sells for $20 per unit, and freol sells for $28.50 per unit.

Carry out all percent calculations to four significant digits.

Required:

1. Allocate the joint costs using the physical units method.

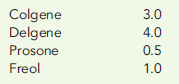

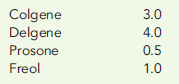

2. Suppose that the products are weighted as follows:

Allocate the joint costs using the weighted average method.

Alomar Company manufactures four products from a joint production process: colgene, delgene, prosone, and freol. The joint costs for one batch are as follows:

At the split-off point, a batch yields 1,200 colgene, 1,800 delgene, 3,000 prosone, and 3,600 freol. All products are sold at the split-off point: colgene sells for $60 per unit, delgene sells for $75 per unit, prosone sells for $20 per unit, and freol sells for $28.50 per unit.

Carry out all percent calculations to four significant digits.

Required:

1. Allocate the joint costs using the physical units method.

2. Suppose that the products are weighted as follows:

Allocate the joint costs using the weighted average method.

Explanation

1.

The allocation of joint cos...

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255