Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Edition 1ISBN: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Edition 1ISBN: 978-0538736787 Exercise 2

CASH RECEIPTS BUDGET AND ACCOUNTS RECEIVABLE AGING SCHEDULE

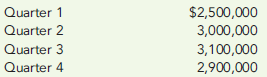

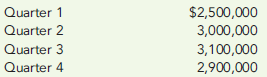

Emerson Company manufactures and sells industrial products. For the next year, 2011, Emerson has budgeted the follow sales:

In Emerson's experience, 10 percent of sales are paid in cash. Of the sales on account, 75 percent are collected in the quarter of sale; 15 percent are collected in the quarter following the sale; and 6 percent are collected in the second quarter after the sale. The remaining 4 percent are never collected. Total sales for the third quarter of the current year are $2,800,000 and for the fourth quarter of the current year are $2,400,000.

Required:

1. Calculate cash sales and credit sales expected in each quarter of 2011.

2. Construct a cash receipts budget including an accounts receivable aging schedule for Emerson Company for each quarter of the coming year, showing the cash sales and the cash collections from credit sales.

3. What if the recession led Emerson's top management to assume that in the coming year 10 percent of credit sales would never be collected? The expected payment percentages in the quarter of sale and the quarter after sale are assumed to be the same. How would that affect cash received in each quarter?

Emerson Company manufactures and sells industrial products. For the next year, 2011, Emerson has budgeted the follow sales:

In Emerson's experience, 10 percent of sales are paid in cash. Of the sales on account, 75 percent are collected in the quarter of sale; 15 percent are collected in the quarter following the sale; and 6 percent are collected in the second quarter after the sale. The remaining 4 percent are never collected. Total sales for the third quarter of the current year are $2,800,000 and for the fourth quarter of the current year are $2,400,000.

Required:

1. Calculate cash sales and credit sales expected in each quarter of 2011.

2. Construct a cash receipts budget including an accounts receivable aging schedule for Emerson Company for each quarter of the coming year, showing the cash sales and the cash collections from credit sales.

3. What if the recession led Emerson's top management to assume that in the coming year 10 percent of credit sales would never be collected? The expected payment percentages in the quarter of sale and the quarter after sale are assumed to be the same. How would that affect cash received in each quarter?

Explanation

1. Calculation of Cash sales:

Credit...

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255