Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Edition 1ISBN: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Edition 1ISBN: 978-0538736787 Exercise 28

STANDARD COSTS, DECOMPOSITION OF BUDGET VARIANCES, DIRECT MATERIALS AND DIRECT LABOR

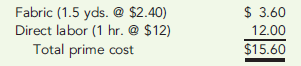

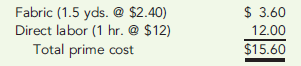

Brookford Corporation produces dress shirts. The company uses a standard costing system and has set the following standards for direct materials and direct labor (for one shirt):

During the year, Brookford produced 6,800 shirts. The actual fabric purchased was 10,750 yards at $2.30 per yard. There were no beginning or ending inventories of fabric. Actual direct labor was 6,850 hours at $12.25 per hour.

Required:

1. Compute the costs of fabric and direct labor that should have been incurred for the production of 6,800 shirts.

2. Compute the total budget variances for direct materials and direct labor.

3. Break down the total budget variance for direct materials into a price variance and a usage variance. Prepare the journal entries associated with these variances.

4. Break down the total budget variance for direct labor into a rate variance and an efficiency variance. Prepare the journal entries associated with these variances.

Brookford Corporation produces dress shirts. The company uses a standard costing system and has set the following standards for direct materials and direct labor (for one shirt):

During the year, Brookford produced 6,800 shirts. The actual fabric purchased was 10,750 yards at $2.30 per yard. There were no beginning or ending inventories of fabric. Actual direct labor was 6,850 hours at $12.25 per hour.

Required:

1. Compute the costs of fabric and direct labor that should have been incurred for the production of 6,800 shirts.

2. Compute the total budget variances for direct materials and direct labor.

3. Break down the total budget variance for direct materials into a price variance and a usage variance. Prepare the journal entries associated with these variances.

4. Break down the total budget variance for direct labor into a rate variance and an efficiency variance. Prepare the journal entries associated with these variances.

Explanation

1.

Cost of direct materials - standard ...

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255