Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Edition 1ISBN: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Edition 1ISBN: 978-0538736787 Exercise 29

KEEP-OR-DROP: TRADITIONAL VERSUS ACTIVITY-BASED ANALYSIS

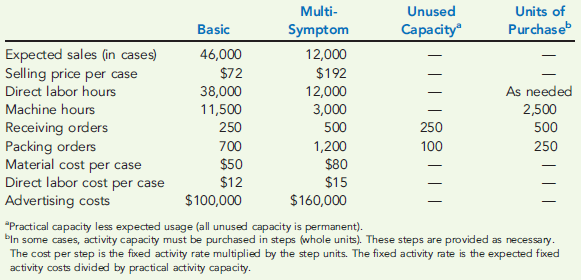

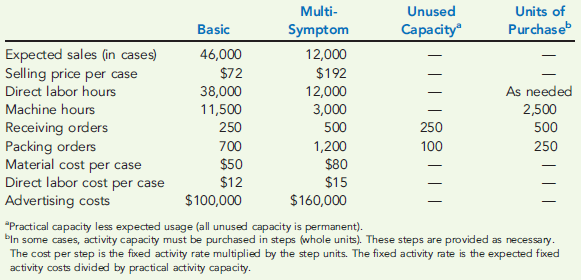

Harding, Inc., produces two types of cough syrup: Basic and Multi-Symptom. Of the two, Basic is the more popular. Data concerning the two products follow:

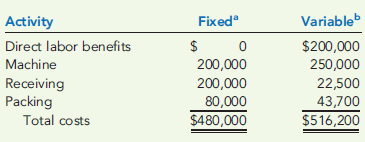

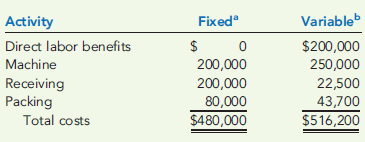

Annual overhead costs are listed below. These costs are classified as fixed or variable with respect to the appropriate activity driver.

Required:

1. Prepare a traditional segmented income statement, using a unit-level overhead rate based on direct labor hours. Using this approach, determine whether the Basic cough syrup product line should be kept or dropped.

2. Prepare an activity-based segmented income statement. Repeat the keep-or-drop analysis using an ABC approach.

Harding, Inc., produces two types of cough syrup: Basic and Multi-Symptom. Of the two, Basic is the more popular. Data concerning the two products follow:

Annual overhead costs are listed below. These costs are classified as fixed or variable with respect to the appropriate activity driver.

Required:

1. Prepare a traditional segmented income statement, using a unit-level overhead rate based on direct labor hours. Using this approach, determine whether the Basic cough syrup product line should be kept or dropped.

2. Prepare an activity-based segmented income statement. Repeat the keep-or-drop analysis using an ABC approach.

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255