Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Edition 1ISBN: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Edition 1ISBN: 978-0538736787 Exercise 9

ABSORPTION COSTING, VALUE OF ENDING INVENTORY, OPERATING INCOME

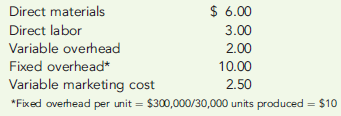

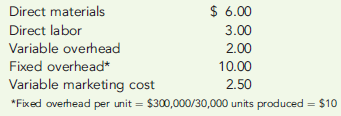

Baxter Products, Inc., began operations in October and manufactured 30,000 units during the month with the following unit costs:

Total fixed factory overhead is $300,000 per month. During October, 28,000 units were sold at a price of $35, and fixed marketing and administrative expenses were $130,500.

Required:

1. Calculate the cost of each unit using absorption costing.

2. How many units remain in ending inventory? What is the cost of ending inventory using absorption costing?

3. Prepare an absorption-costing income statement for Baxter Products, Inc., for the month of October.

4. What if November production was 30,000 units, costs were stable, and sales were 31,000 units? What is the cost of ending inventory? What is operating income for November?

Baxter Products, Inc., began operations in October and manufactured 30,000 units during the month with the following unit costs:

Total fixed factory overhead is $300,000 per month. During October, 28,000 units were sold at a price of $35, and fixed marketing and administrative expenses were $130,500.

Required:

1. Calculate the cost of each unit using absorption costing.

2. How many units remain in ending inventory? What is the cost of ending inventory using absorption costing?

3. Prepare an absorption-costing income statement for Baxter Products, Inc., for the month of October.

4. What if November production was 30,000 units, costs were stable, and sales were 31,000 units? What is the cost of ending inventory? What is operating income for November?

Explanation

1)

Calculate unit cost using absorption...

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255