Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 39

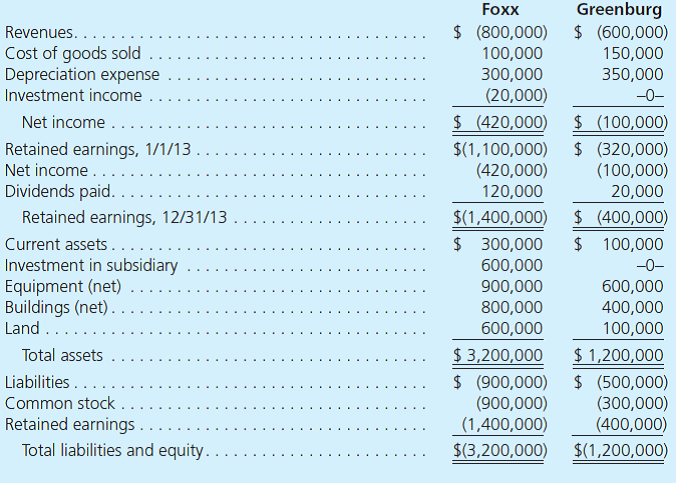

Foxx Corporation acquired all of Greenburg Company's outstanding stock on January 1, 2011, for $600,000 cash. Greenburg's accounting records showed net assets on that date of $470,000, although equipment with a 10-year life was undervalued on the records by $90,000. Any recognized goodwill is considered to have an indefinite life.

Greenburg reports net income in 2011 of $90,000 and $100,000 in 2012. The subsidiary paid dividends of $20,000 in each of these two years.

Financial figures for the year ending December 31, 2013, follow. Credit balances are indicated by parentheses.

a. Determine the December 31, 2013, consolidated balance for each of the following accounts:

b. How does the parent's choice of an accounting method for its investment affect the balances computed in requirement ( a )

c. Which method of accounting for this subsidiary is the parent actually using for internal reporting purposes

d. If the parent company had used a different method of accounting for this investment, how could that method have been identified

e. What would be Foxx's balance for retained earnings as of January 1, 2013, if each of the following methods had been in use

Initial value method

Partial equity method

Equity method

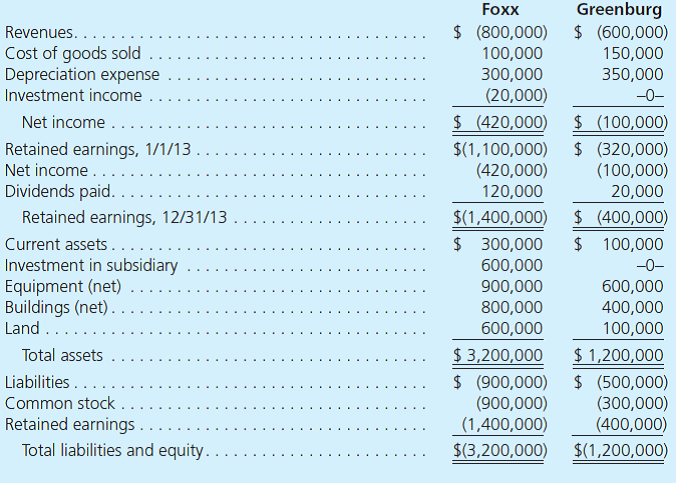

Greenburg reports net income in 2011 of $90,000 and $100,000 in 2012. The subsidiary paid dividends of $20,000 in each of these two years.

Financial figures for the year ending December 31, 2013, follow. Credit balances are indicated by parentheses.

a. Determine the December 31, 2013, consolidated balance for each of the following accounts:

b. How does the parent's choice of an accounting method for its investment affect the balances computed in requirement ( a )

c. Which method of accounting for this subsidiary is the parent actually using for internal reporting purposes

d. If the parent company had used a different method of accounting for this investment, how could that method have been identified

e. What would be Foxx's balance for retained earnings as of January 1, 2013, if each of the following methods had been in use

Initial value method

Partial equity method

Equity method

Explanation

(Consolidated balances three years after...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255