Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 11

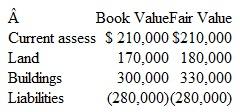

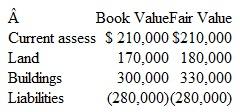

Parker, Inc.. acquires 70 percent of Sawyer Company for $420,000. The remaining.30 percent of Sawyer's outstanding shares continue to trade at a collective value of $174,000. On the acquisition date, Sawyer has the following accounts:

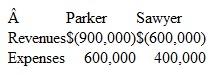

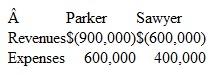

The buildings have a 10-year life. In addition, Sawyer holds a patent worth $140,000 that has a five-year life but is not recorded on its financial records. At the end of the year, the two companies report the following balances:

a. Assume that the acquisition took place on January 1. What figures would appear in a consolidated income statement for this year

b. Assume that the acquisition took place on April 1. Sawyer's revenues and expenses occurred uniformly throughout the year. What amounts would appear in a consolidated income statement for this year

The buildings have a 10-year life. In addition, Sawyer holds a patent worth $140,000 that has a five-year life but is not recorded on its financial records. At the end of the year, the two companies report the following balances:

a. Assume that the acquisition took place on January 1. What figures would appear in a consolidated income statement for this year

b. Assume that the acquisition took place on April 1. Sawyer's revenues and expenses occurred uniformly throughout the year. What amounts would appear in a consolidated income statement for this year

Explanation

Consolidated income statement is the fin...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255