Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 41

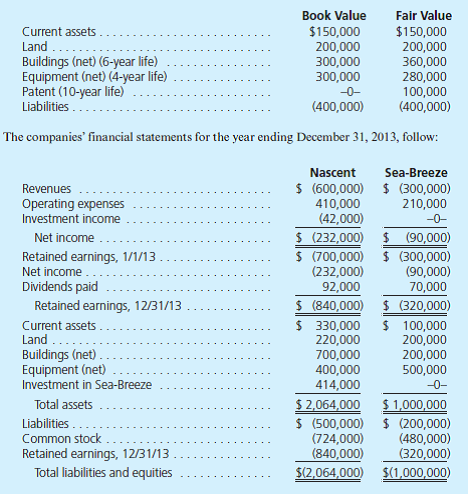

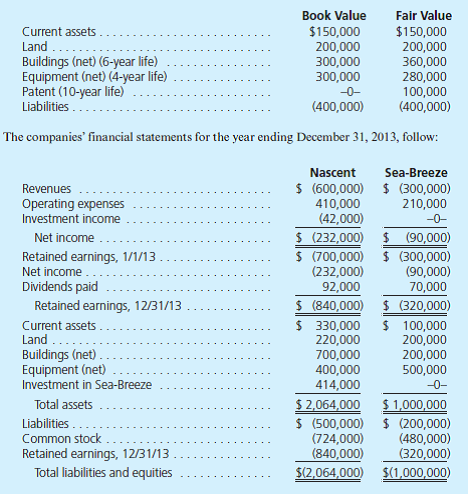

Nascent, Inc., acquires 60 percent of Sea-Breeze Corporation for $414,000 cash on January 1, 2010. The remaining 40 percent of the Sea-Breeze shares traded near a total value of $276,000 both before and after the acquisition date. On January 1, 2010, Sea-Breeze had the following assets and liabilities:

Answer the following questions:

a. How can the accountant determine that the parent has applied the initial value method

b. What is the annual excess amortization initially recognized in connection with this acquisition

c. If the parent had applied the equity method, what investment income would the parent have recorded in 2013

d. What is the parent's portion of consolidated retained earnings as of January 1, 2013

e. What is consolidated net income for 2013 and what amounts are attributable to the controlling and noncontrolling interests

f. Within consolidated statements at January 1, 2010, what balance is included for the subsidiary's Buildings account

g. What is the consolidated Buildings reported balance as of December 31, 2013

Answer the following questions:

a. How can the accountant determine that the parent has applied the initial value method

b. What is the annual excess amortization initially recognized in connection with this acquisition

c. If the parent had applied the equity method, what investment income would the parent have recorded in 2013

d. What is the parent's portion of consolidated retained earnings as of January 1, 2013

e. What is consolidated net income for 2013 and what amounts are attributable to the controlling and noncontrolling interests

f. Within consolidated statements at January 1, 2010, what balance is included for the subsidiary's Buildings account

g. What is the consolidated Buildings reported balance as of December 31, 2013

Explanation

"Consolidated Financial Statement:"

"The...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255