Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 11

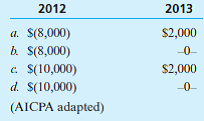

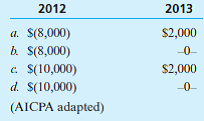

Dunn Corporation owns 100 percent of Grey Corporation's common stock. On January 2, 2012, Dunn sold to Grey $40,000 of machinery with a carrying amount of $30,000. Grey is depreciating the acquired machinery over a five-year life by the straight-line method. The net adjustments to compute 2012 and 2013 consolidated net income would be an increase (decrease) of

Explanation

Non-depreciable assets like land does no...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255