Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 6

On January 1, 2011, Plymouth Corporation acquired 80 percent of the outstanding voting stock of Sander Company in exchange for $1,200,000 cash. At that time, although Sander's book value was $925,000, Plymouth assessed Sander's total business fair value at $1,500,000.

Since that time, Sander has neither issued nor reacquired any shares of its own stock.

The book values of Sander's individual assets and liabilities approximated their acquisitiondate fair values except for the patent account, which was undervalued by $350,000. The undervalued patents had a 5-year remaining life at the acquisition date. Any remaining excess fair value was attributed to goodwill. No goodwill impairments have occurred.

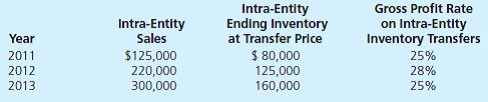

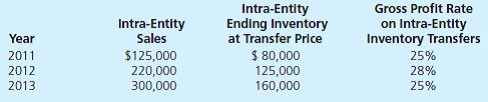

Sander regularly sells inventory to Plymouth. Below are details of the intra-entity inventory sales for the past three years:

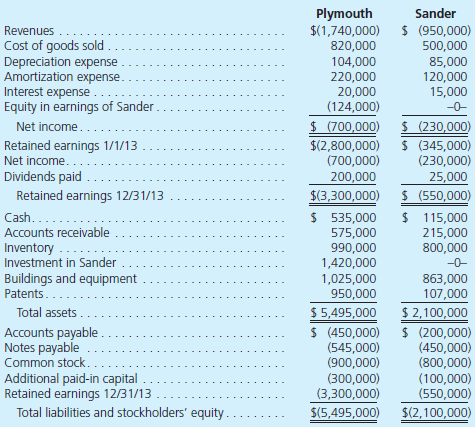

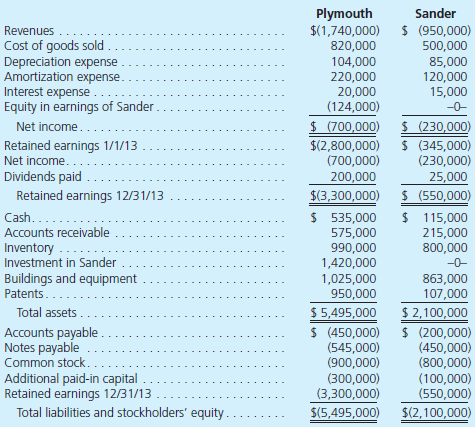

Separate financial statements for these two companies as of December 31, 2013, follow:

a. Prepare a schedule that calculates the Equity in Earnings of Sander account balance.

b. Prepare a worksheet to arrive at consolidated figures for external reporting purposes.

Since that time, Sander has neither issued nor reacquired any shares of its own stock.

The book values of Sander's individual assets and liabilities approximated their acquisitiondate fair values except for the patent account, which was undervalued by $350,000. The undervalued patents had a 5-year remaining life at the acquisition date. Any remaining excess fair value was attributed to goodwill. No goodwill impairments have occurred.

Sander regularly sells inventory to Plymouth. Below are details of the intra-entity inventory sales for the past three years:

Separate financial statements for these two companies as of December 31, 2013, follow:

a. Prepare a schedule that calculates the Equity in Earnings of Sander account balance.

b. Prepare a worksheet to arrive at consolidated figures for external reporting purposes.

Explanation

Investment balance a...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255