Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 8

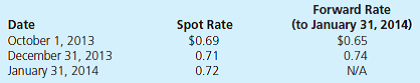

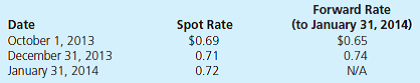

On October 1, 2013, Hanks Company entered into a forward contract to sell 100,000 LCUs in four months (on January 31, 2014) and receive $65,000 in U.S. dollars. Exchange rates for the LCU follow:

Hanks's incremental borrowing rate is 12 percent. The present value factor for one month at an annual interest rate of 12 percent (1 percent per month) is 0.9901. Hanks must close its books and prepare financial statements on December 31.

a. Prepare journal entries, assuming that Hanks entered into the forward contract as a fair value hedge of a 100,000 LCU receivable arising from a sale made on October 1, 2013. Include entries for both the sale and the forward contract.

b. Prepare journal entries, assuming that Hanks entered into the forward contract as a fair value hedge of a firm commitment related to a 100,000 LCU sale that will be made on January 31, 2014. Include entries for both the firm commitment and the forward contract. The fair value of the firm commitment is measured referring to changes in the forward rate.

Hanks's incremental borrowing rate is 12 percent. The present value factor for one month at an annual interest rate of 12 percent (1 percent per month) is 0.9901. Hanks must close its books and prepare financial statements on December 31.

a. Prepare journal entries, assuming that Hanks entered into the forward contract as a fair value hedge of a 100,000 LCU receivable arising from a sale made on October 1, 2013. Include entries for both the sale and the forward contract.

b. Prepare journal entries, assuming that Hanks entered into the forward contract as a fair value hedge of a firm commitment related to a 100,000 LCU sale that will be made on January 31, 2014. Include entries for both the firm commitment and the forward contract. The fair value of the firm commitment is measured referring to changes in the forward rate.

Explanation

"Foreign Currency transaction:"

"In case...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255