Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159 Exercise 6

Journal entries and trial balance

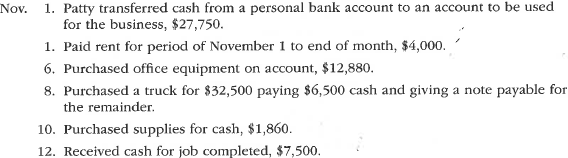

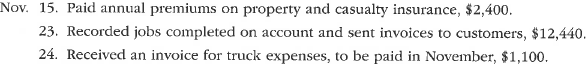

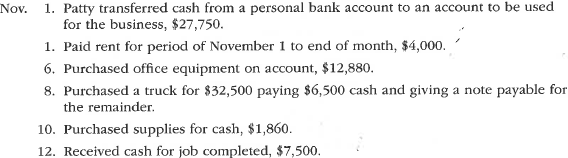

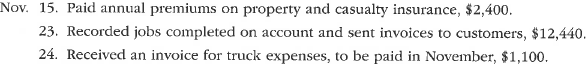

On November 1, 2016, Patty Cosgrove established an interior decorating business, Classic Designs. During the month, Patty completed the following transactions related to the business:

Enter the following transactions on Page 2 of the two-column journal:

Instructions

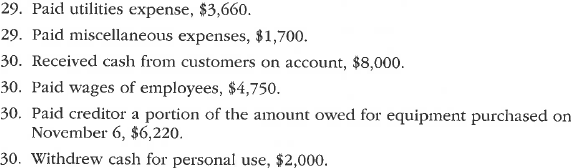

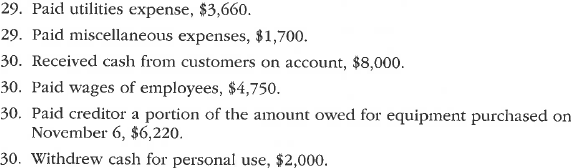

1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Explanations may be omitted.

2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted.

3. Prepare an unadjusted trial balance for Classic Designs as of November 30, 2016.

4. Determine the excess of revenues over expenses for November.

5. Can you think of any reason why the amount determined in (4) might not be the net income for November

On November 1, 2016, Patty Cosgrove established an interior decorating business, Classic Designs. During the month, Patty completed the following transactions related to the business:

Enter the following transactions on Page 2 of the two-column journal:

Instructions

1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Explanations may be omitted.

2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted.

3. Prepare an unadjusted trial balance for Classic Designs as of November 30, 2016.

4. Determine the excess of revenues over expenses for November.

5. Can you think of any reason why the amount determined in (4) might not be the net income for November

Explanation

1.Journal entries:

Page 1

Page...

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255