Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159 Exercise 17

Bank reconciliation and entries

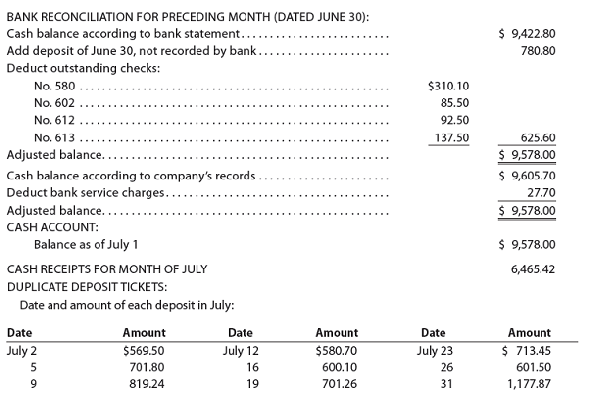

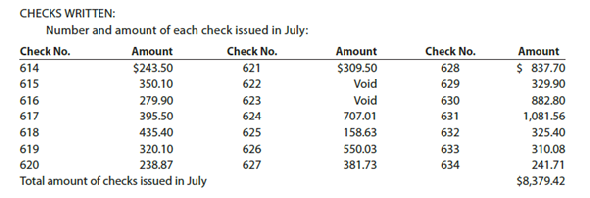

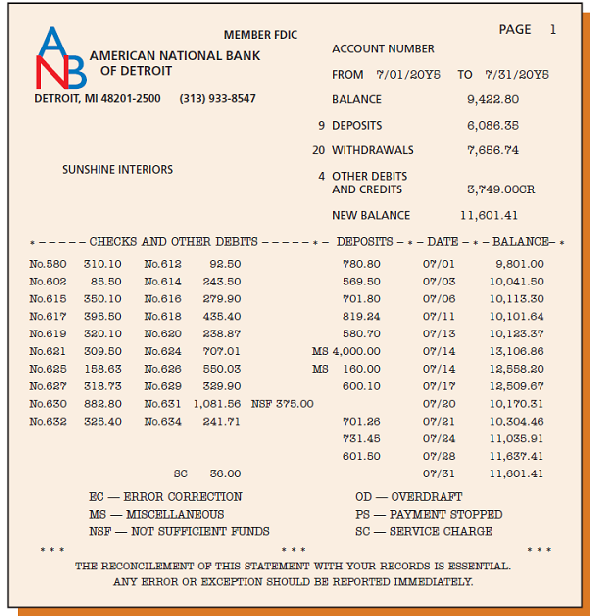

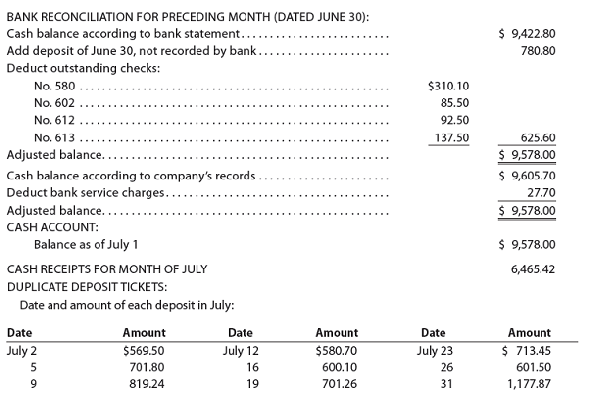

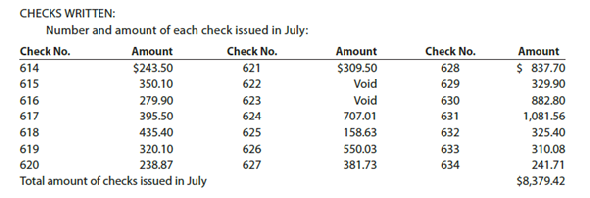

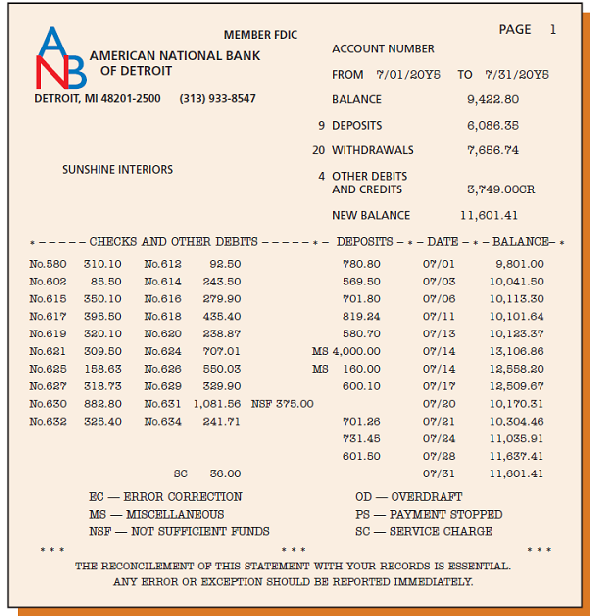

Sunshine Interiors deposits all cash receipts each Wednesday and Friday in a night depository after banking hours. The data required to reconcile the bank statement as of July 31 have been taken from various documents and records and are reproduced as follows. The sources of the data are printed in capital letters. All checks were written for payments on account.

JULY BANK STATEMENT:

Instructions

1. Prepare a bank reconciliation as of July 31. If errors in recording deposits or checks are discovered, assume that the errors were made by the company. Assume that all deposits are from cash sales. All checks are written to satisfy accounts payable.

2. Journalize the necessary entries. The accounts have not been closed.

3. What is the amount of Cash that should appear on the balance sheet as of July 31

4. Assume that a canceled check for $180 has been incorrectly recorded by the bank as $1,800. Briefly explain how the error would be included in a bank reconciliation and how it should be corrected.

Sunshine Interiors deposits all cash receipts each Wednesday and Friday in a night depository after banking hours. The data required to reconcile the bank statement as of July 31 have been taken from various documents and records and are reproduced as follows. The sources of the data are printed in capital letters. All checks were written for payments on account.

JULY BANK STATEMENT:

Instructions

1. Prepare a bank reconciliation as of July 31. If errors in recording deposits or checks are discovered, assume that the errors were made by the company. Assume that all deposits are from cash sales. All checks are written to satisfy accounts payable.

2. Journalize the necessary entries. The accounts have not been closed.

3. What is the amount of Cash that should appear on the balance sheet as of July 31

4. Assume that a canceled check for $180 has been incorrectly recorded by the bank as $1,800. Briefly explain how the error would be included in a bank reconciliation and how it should be corrected.

Explanation

1.In bank reconciliation, we record all ...

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255