Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159 Exercise 13

Recording partner's original investment

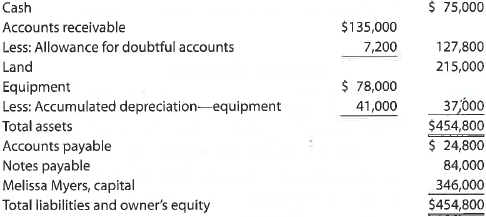

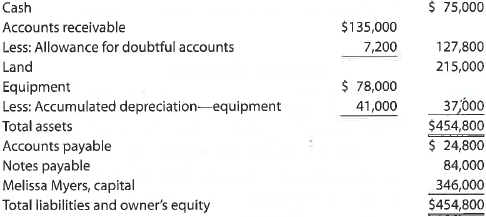

Melissa Myers and Hugo Hernandez form a partnership by combining assets of their former businesses. The following balance sheet information is provided by Myers, sole proprietorship:

Myers obtained appraised values for the land and equipment as follows:

An analysis of the accounts receivable indicated that the allowance for doubtful accounts should be increased to $9,200.

Journalize the partnership's entry for Myers' investment.

Melissa Myers and Hugo Hernandez form a partnership by combining assets of their former businesses. The following balance sheet information is provided by Myers, sole proprietorship:

Myers obtained appraised values for the land and equipment as follows:

An analysis of the accounts receivable indicated that the allowance for doubtful accounts should be increased to $9,200.

Journalize the partnership's entry for Myers' investment.

Explanation

To journalize the partnership's entry fo...

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255