Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Edition 26ISBN: 978-1337498159 Exercise 44

Dividends on preferred and common stock

Sunbird Theatre Inc. owns and operates movie theaters throughout Florida and Georgia. Sunbird Theatre Inc. has declared the following annual dividends over a six-year period: 2011, $20,000; 2012, $36,000; 2013, $70,000; 2014, $90,000; 2015, $100,000 and 2016, $150,000. During the entire period ended December 31 of each year, the outstanding stock of the company was composed of 100,000 shares of cumulative, preferred 1% stock $30 par, and 400,000 shares of common stock, $20 par.

Instructions

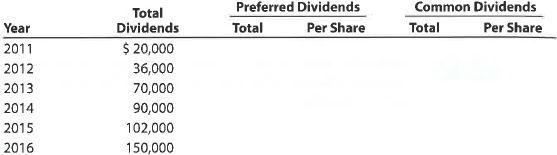

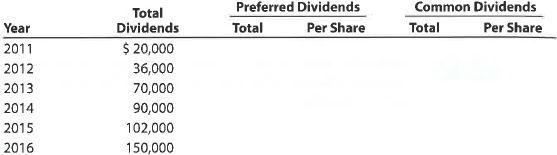

1. Calculate the total dividends and the per-share dividends declared on each class of stock for each of the six years. There were no dividends in arrears on January 1, 2011. Summarize the data in tabular form, using the following column headings:

2. Calculate the average annual dividend per share for each class of stock for the six-year period.

3. Assuming a market price per share of $37.50 for the preferred stock and $30.00 for the common stock, calculate the average annual percentage return on initial shareholders' investment, based on the average annual dividend per share (a) for preferred stock and (b) for common stock.

Sunbird Theatre Inc. owns and operates movie theaters throughout Florida and Georgia. Sunbird Theatre Inc. has declared the following annual dividends over a six-year period: 2011, $20,000; 2012, $36,000; 2013, $70,000; 2014, $90,000; 2015, $100,000 and 2016, $150,000. During the entire period ended December 31 of each year, the outstanding stock of the company was composed of 100,000 shares of cumulative, preferred 1% stock $30 par, and 400,000 shares of common stock, $20 par.

Instructions

1. Calculate the total dividends and the per-share dividends declared on each class of stock for each of the six years. There were no dividends in arrears on January 1, 2011. Summarize the data in tabular form, using the following column headings:

2. Calculate the average annual dividend per share for each class of stock for the six-year period.

3. Assuming a market price per share of $37.50 for the preferred stock and $30.00 for the common stock, calculate the average annual percentage return on initial shareholders' investment, based on the average annual dividend per share (a) for preferred stock and (b) for common stock.

Explanation

1.Dividends are declared and paid by the...

Accounting 26th Edition by Carl Warren ,Jim Reeve ,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255